Week 2: Linear Regression

DSAN 5300: Statistical Learning

Spring 2025, Georgetown University

Monday, January 13, 2025

Linear Regression

What happens to my dependent variable \(Y\) when my independent variable \(X\) changes by 1 unit?

Whenever you carry out a regression, keep the goal in the front of your mind:

The Goal of Regression

Find a line \(\widehat{y} = mx + b\) that best predicts \(Y\) for given values of \(X\)

\[ \DeclareMathOperator*{\argmax}{argmax} \DeclareMathOperator*{\argmin}{argmin} \newcommand{\bigexp}[1]{\exp\mkern-4mu\left[ #1 \right]} \newcommand{\bigexpect}[1]{\mathbb{E}\mkern-4mu \left[ #1 \right]} \newcommand{\definedas}{\overset{\small\text{def}}{=}} \newcommand{\definedalign}{\overset{\phantom{\text{defn}}}{=}} \newcommand{\eqeventual}{\overset{\text{eventually}}{=}} \newcommand{\Err}{\text{Err}} \newcommand{\expect}[1]{\mathbb{E}[#1]} \newcommand{\expectsq}[1]{\mathbb{E}^2[#1]} \newcommand{\fw}[1]{\texttt{#1}} \newcommand{\given}{\mid} \newcommand{\green}[1]{\color{green}{#1}} \newcommand{\heads}{\outcome{heads}} \newcommand{\iid}{\overset{\text{\small{iid}}}{\sim}} \newcommand{\lik}{\mathcal{L}} \newcommand{\loglik}{\ell} \DeclareMathOperator*{\maximize}{maximize} \DeclareMathOperator*{\minimize}{minimize} \newcommand{\mle}{\textsf{ML}} \newcommand{\nimplies}{\;\not\!\!\!\!\implies} \newcommand{\orange}[1]{\color{orange}{#1}} \newcommand{\outcome}[1]{\textsf{#1}} \newcommand{\param}[1]{{\color{purple} #1}} \newcommand{\pgsamplespace}{\{\green{1},\green{2},\green{3},\purp{4},\purp{5},\purp{6}\}} \newcommand{\prob}[1]{P\left( #1 \right)} \newcommand{\purp}[1]{\color{purple}{#1}} \newcommand{\sign}{\text{Sign}} \newcommand{\spacecap}{\; \cap \;} \newcommand{\spacewedge}{\; \wedge \;} \newcommand{\tails}{\outcome{tails}} \newcommand{\Var}[1]{\text{Var}[#1]} \newcommand{\bigVar}[1]{\text{Var}\mkern-4mu \left[ #1 \right]} \]

How Do We Define “Best”?

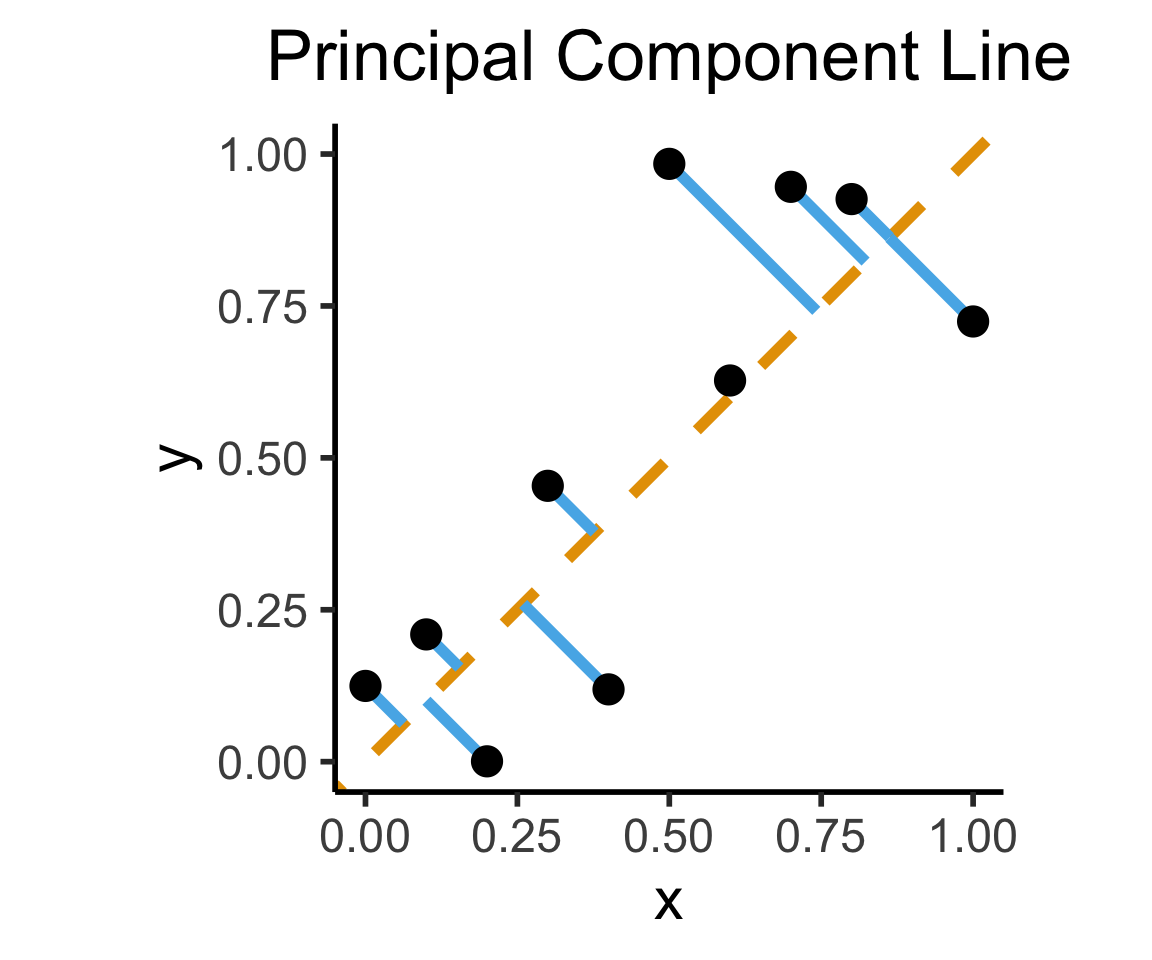

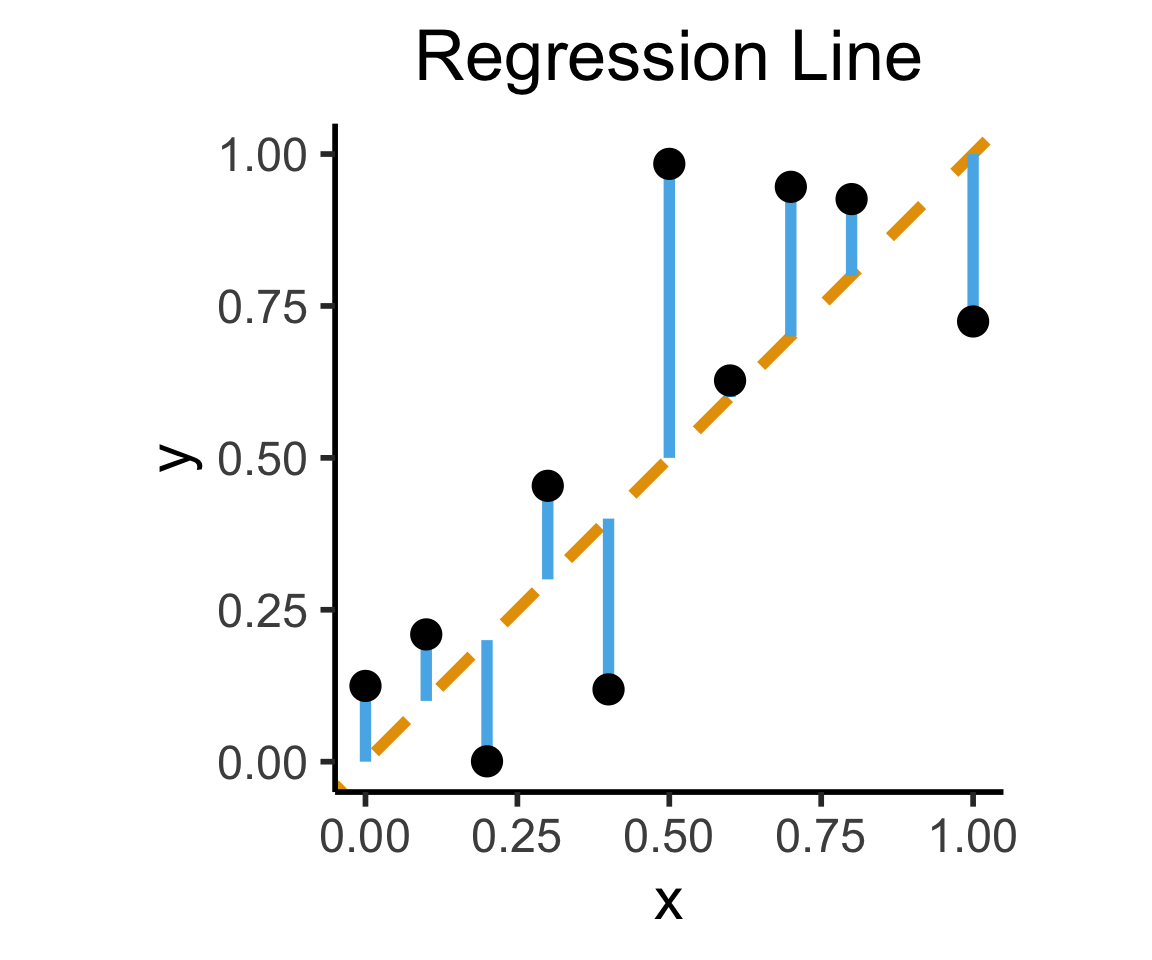

- Intuitively, two different ways to measure how well a line fits the data:

Code

library(tidyverse)

set.seed(5321)

N <- 11

x <- seq(from = 0, to = 1, by = 1 / (N - 1))

y <- x + rnorm(N, 0, 0.2)

mean_y <- mean(y)

spread <- y - mean_y

df <- tibble(x = x, y = y, spread = spread)

ggplot(df, aes(x=x, y=y)) +

geom_abline(slope=1, intercept=0, linetype="dashed", color=cbPalette[1], linewidth=g_linewidth*2) +

geom_segment(xend=(x+y)/2, yend=(x+y)/2, linewidth=g_linewidth*2, color=cbPalette[2]) +

geom_point(size=g_pointsize) +

coord_equal() +

xlim(0, 1) + ylim(0, 1) +

dsan_theme("half") +

labs(

title = "Principal Component Line"

)

ggplot(df, aes(x=x, y=y)) +

geom_abline(slope=1, intercept=0, linetype="dashed", color=cbPalette[1], linewidth=g_linewidth*2) +

geom_segment(xend=x, yend=x, linewidth=g_linewidth*2, color=cbPalette[2]) +

geom_point(size=g_pointsize) +

coord_equal() +

xlim(0, 1) + ylim(0, 1) +

dsan_theme("half") +

labs(

title = "Regression Line"

)

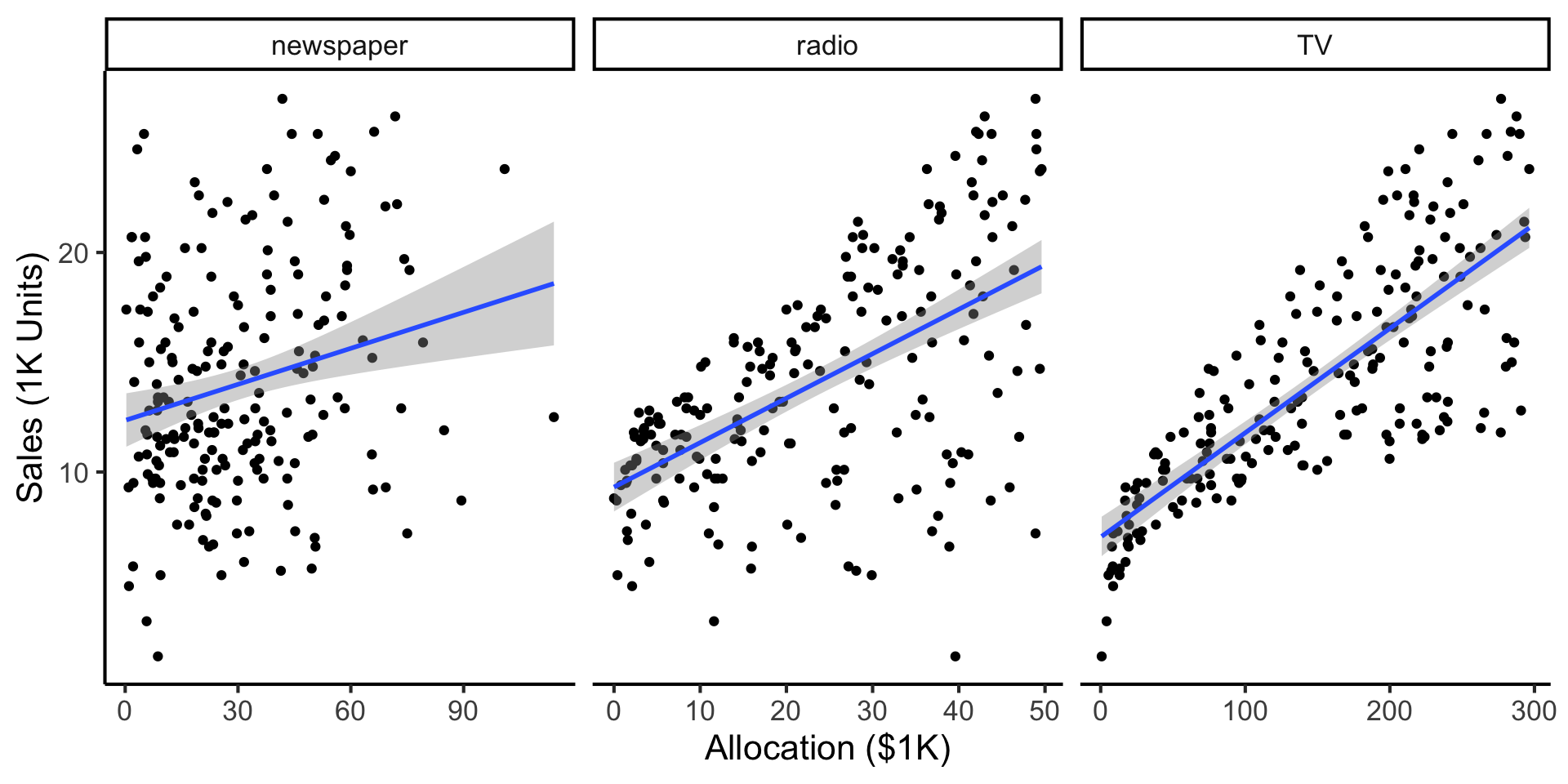

Predictive Example: Advertising Effects

- Independent variable: $ put into advertisements

- Dependent variable: Sales

- Goal: Figure out a good way to allocate an advertising budget

Code

library(tidyverse)

ad_df <- read_csv("assets/Advertising.csv") |> rename(id=`...1`)

long_df <- ad_df |> pivot_longer(-c(id, sales), names_to="medium", values_to="allocation")

long_df |> ggplot(aes(x=allocation, y=sales)) +

geom_point() +

facet_wrap(vars(medium), scales="free_x") +

geom_smooth(method='lm', formula="y ~ x") +

theme_dsan() +

labs(

x = "Allocation ($1K)",

y = "Sales (1K Units)"

)

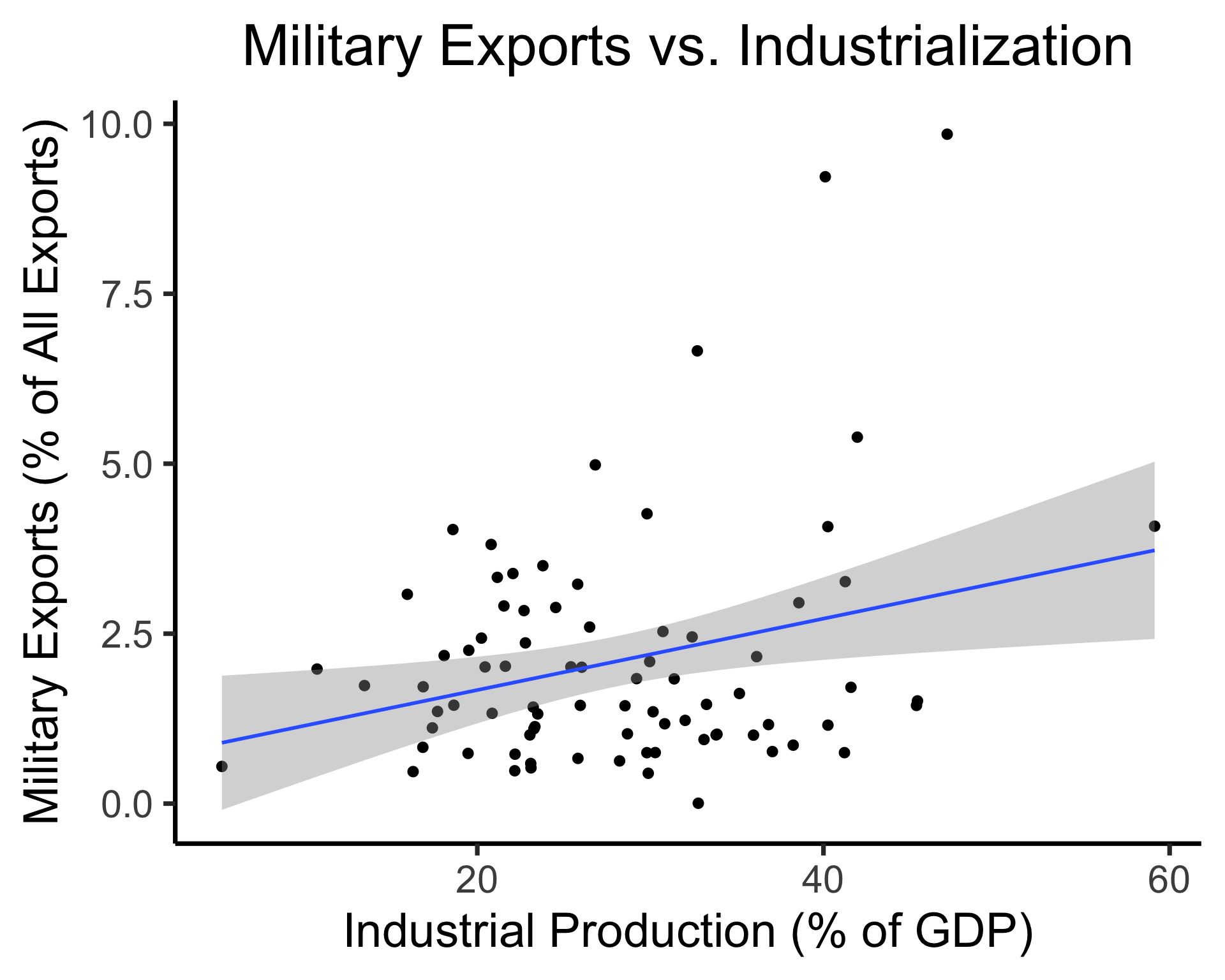

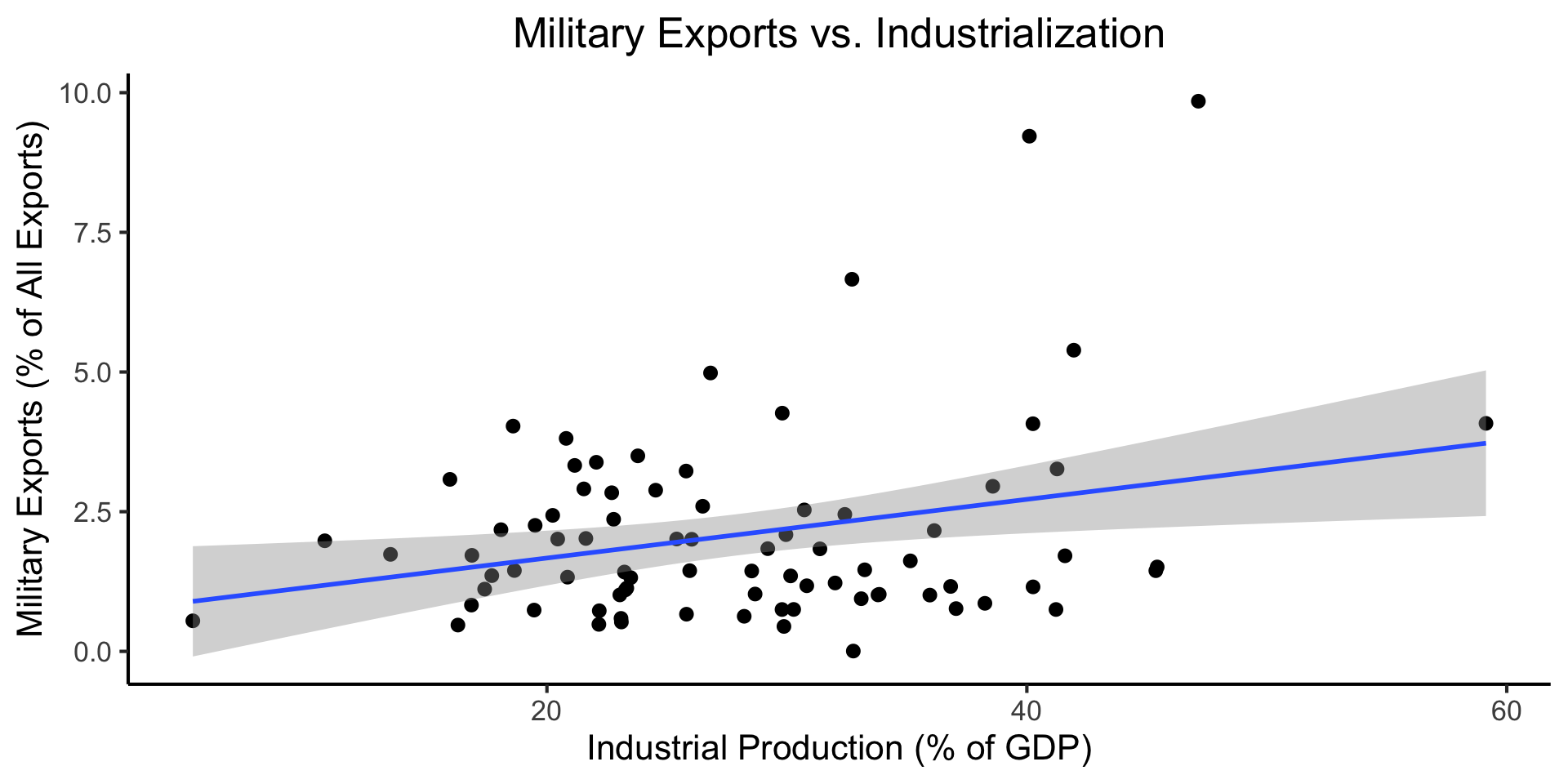

Explanatory Example: Industrialization Effects

Code

library(tidyverse)

gdp_df <- read_csv("assets/gdp_pca.csv")

mil_plot <- gdp_df |> ggplot(aes(x=industrial, y=military)) +

geom_point(size=0.5*g_pointsize) +

geom_smooth(method='lm', formula="y ~ x", linewidth=1) +

theme_dsan() +

labs(

title="Military Exports vs. Industrialization",

x="Industrial Production (% of GDP)",

y="Military Exports (% of All Exports)"

)

mil_plot

Simple Linear Regression

For now, we treat Newspaper, Radio, TV advertising separately: how much do sales increase per $1 into [medium]? (Later we’ll consider them jointly: multiple regression)

Our model:

\[ Y = \underbrace{\param{\beta_0}}_{\mathclap{\text{Intercept}}} + \underbrace{\param{\beta_1}}_{\mathclap{\text{Slope}}}X + \varepsilon \]

This model generates predictions via

\[ \widehat{y} = \underbrace{\widehat{\beta_0}}_{\mathclap{\small\begin{array}{c}\text{Estimated} \\[-5mm] \text{intercept}\end{array}}} ~+~ \underbrace{\widehat{\beta_1}}_{\mathclap{\small\begin{array}{c}\text{Estimated} \\[-4mm] \text{slope}\end{array}}}\cdot x \]

Note how these predictions will be wrong (unless the data is perfectly linear)

We’ve accounted for this in our model (by including \(\varepsilon\) term)!

But, we’d like to find estimates \(\widehat{\beta}_0\) and \(\widehat{\beta}_1\) that produce the “least wrong” predictions: motivates focus on residuals…

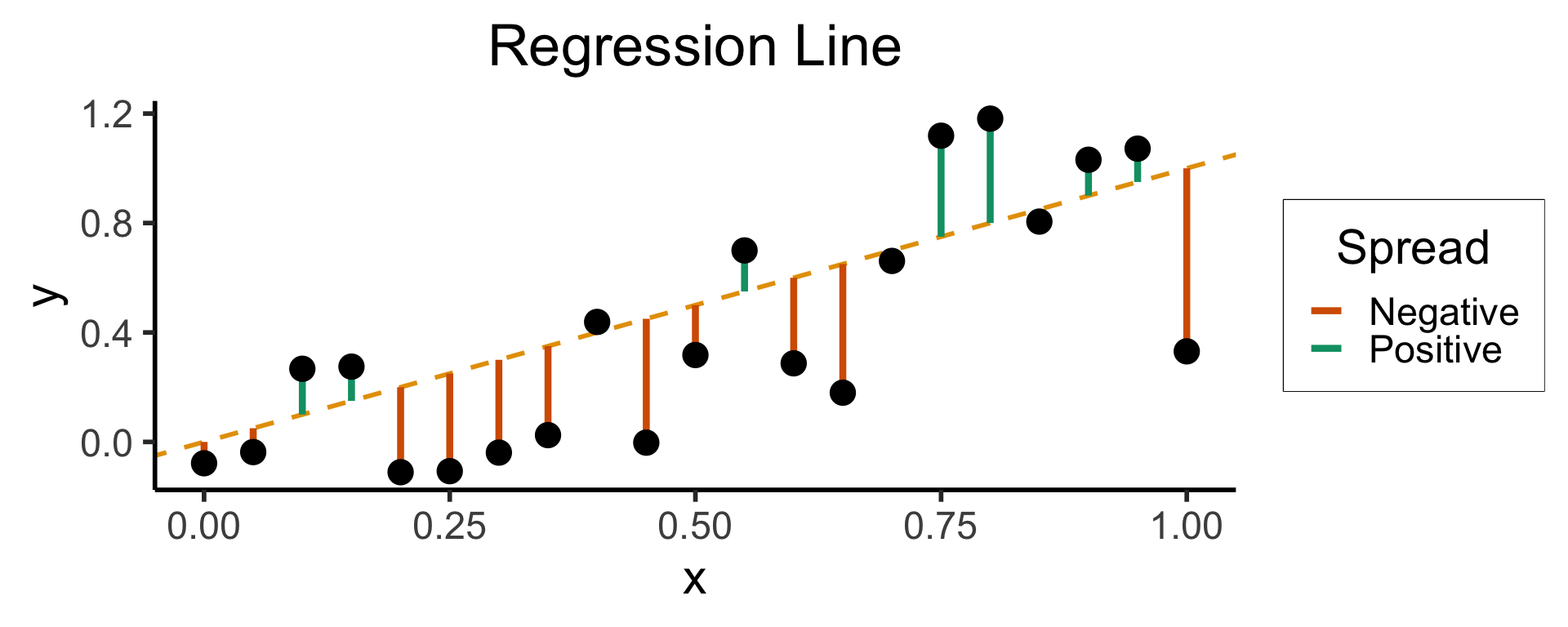

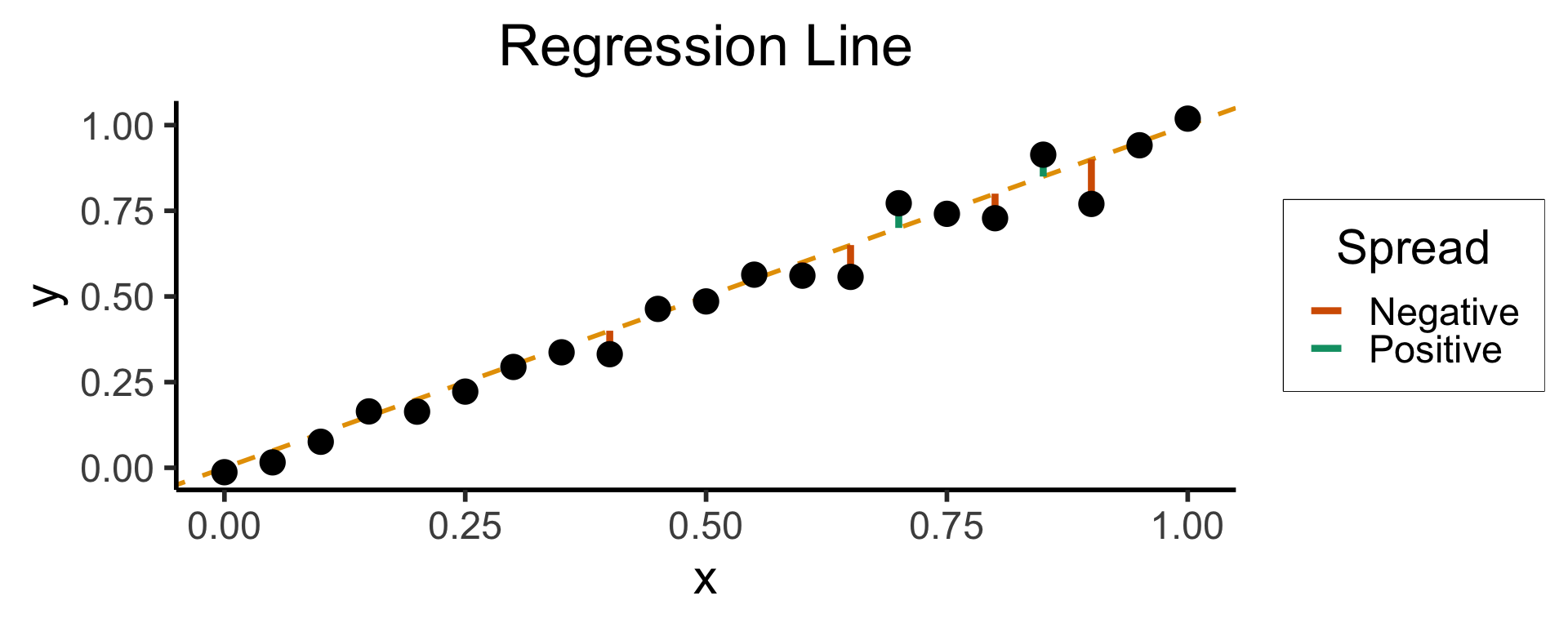

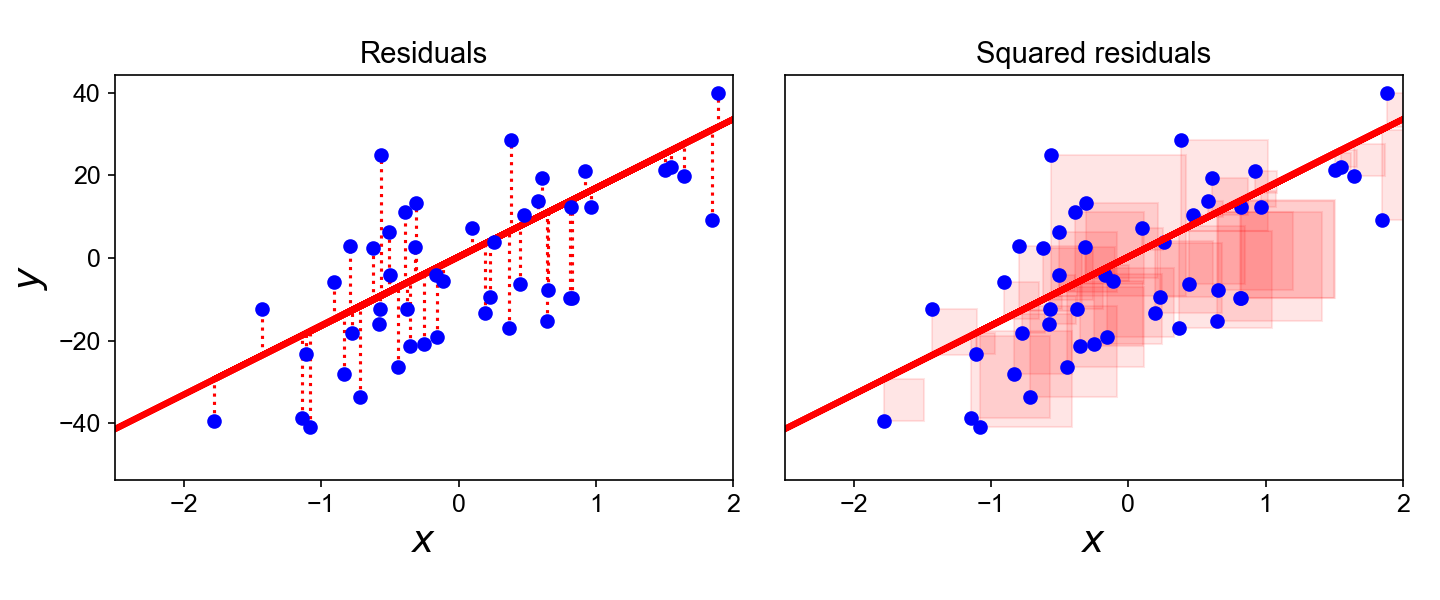

Least Squares: Minimizing Residuals

What can we optimize to ensure these residuals are as small as possible?

Code

N <- 21

x <- seq(from = 0, to = 1, by = 1 / (N - 1))

y <- x + rnorm(N, 0, 0.25)

mean_y <- mean(y)

spread <- y - mean_y

sim_lg_df <- tibble(x = x, y = y, spread = spread)

sim_lg_df |> ggplot(aes(x=x, y=y)) +

geom_abline(slope=1, intercept=0, linetype="dashed", color=cbPalette[1], linewidth=g_linewidth) +

# geom_segment(xend=x, yend=x, linewidth=g_linewidth*2, color=cbPalette[2]) +

geom_segment(aes(xend=x, yend=x, color=ifelse(y>x,"Positive","Negative")), linewidth=1.5*g_linewidth) +

geom_point(size=g_pointsize) +

# coord_equal() +

theme_dsan("half") +

scale_color_manual("Spread", values=c("Positive"=cbPalette[3],"Negative"=cbPalette[6]), labels=c("Positive"="Positive","Negative"="Negative")) +

labs(

title = "Regression Line"

)

Code

N <- 21

x <- seq(from = 0, to = 1, by = 1 / (N - 1))

y <- x + rnorm(N, 0, 0.05)

mean_y <- mean(y)

spread <- y - mean_y

sim_sm_df <- tibble(x = x, y = y, spread = spread)

sim_sm_df |> ggplot(aes(x=x, y=y)) +

geom_abline(slope=1, intercept=0, linetype="dashed", color=cbPalette[1], linewidth=g_linewidth) +

# geom_segment(xend=x, yend=x, linewidth=g_linewidth*2, color=cbPalette[2]) +

geom_segment(aes(xend=x, yend=x, color=ifelse(y>x,"Positive","Negative")), linewidth=1.5*g_linewidth) +

geom_point(size=g_pointsize) +

# coord_equal() +

theme_dsan("half") +

scale_color_manual("Spread", values=c("Positive"=cbPalette[3],"Negative"=cbPalette[6]), labels=c("Positive"="Positive","Negative"="Negative")) +

labs(

title = "Regression Line"

)

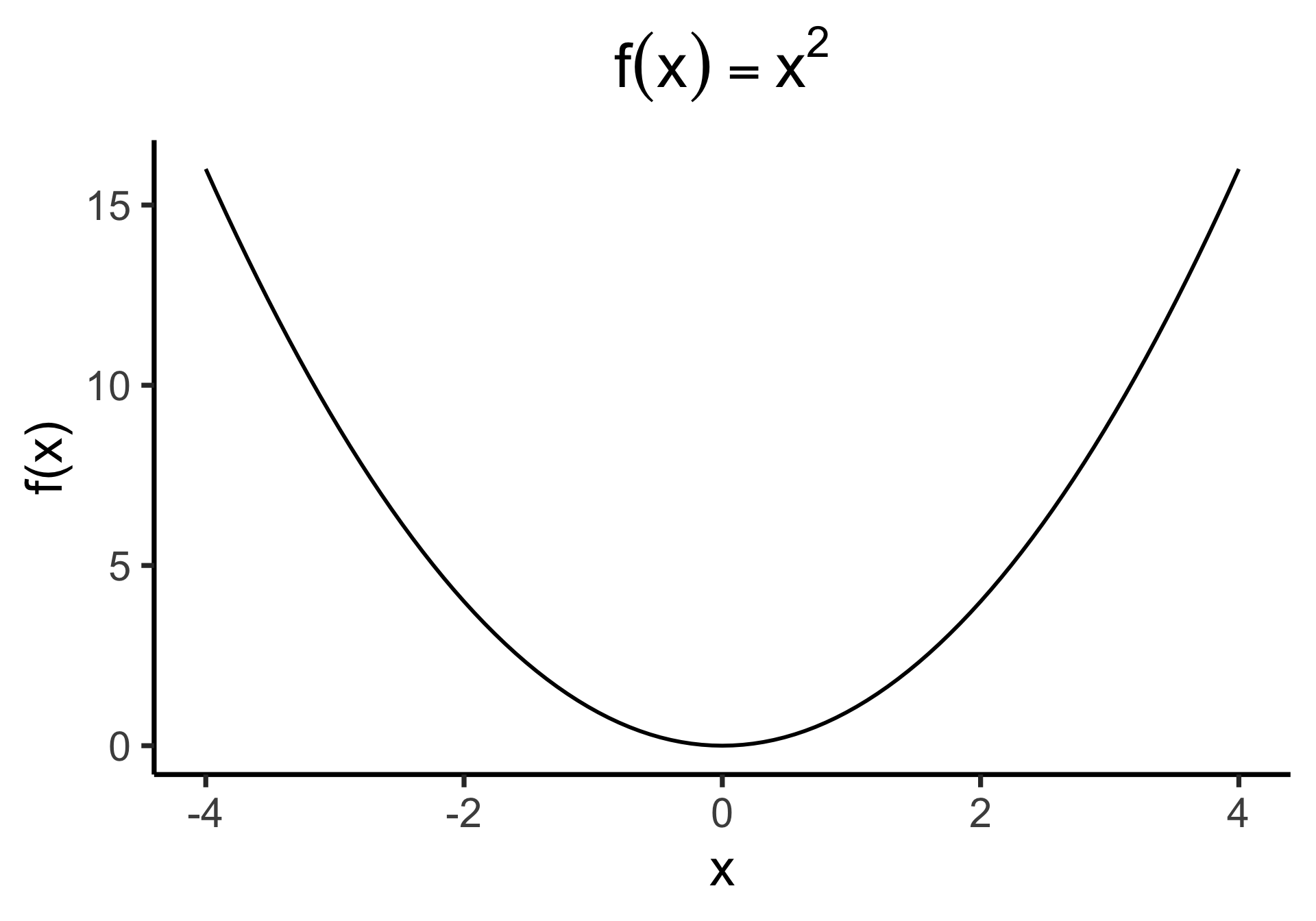

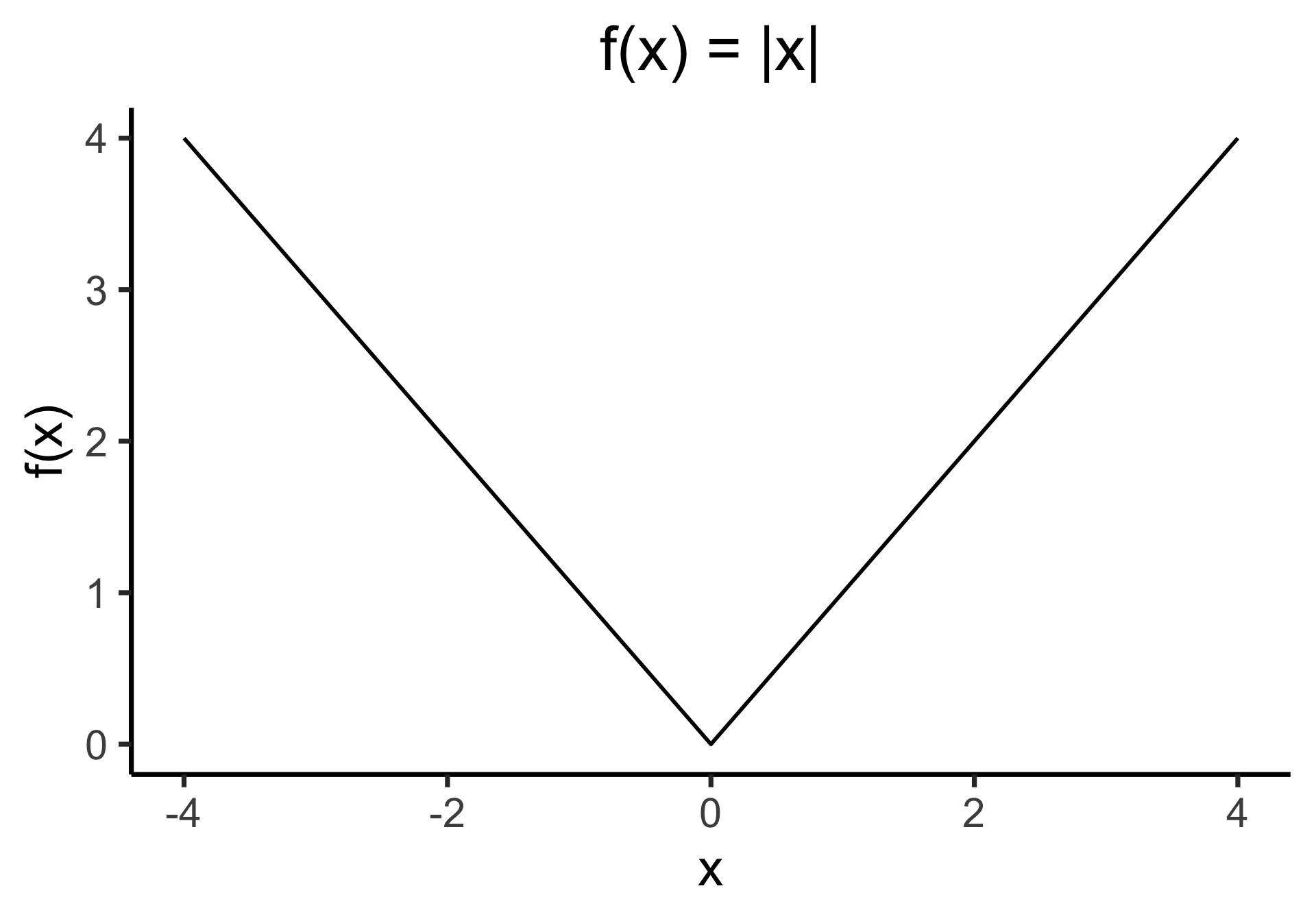

Why Not Absolute Value?

- Two feasible ways to prevent positive and negative residuals cancelling out:

- Absolute value \(\left|y - \widehat{y}\right|\) or squaring \(\left( y - \widehat{y} \right)^2\)

- But remember that we’re aiming to minimize these residuals…

- Ghost of calculus past 😱: which is differentiable everywhere?

Outliers Penalized Quadratically

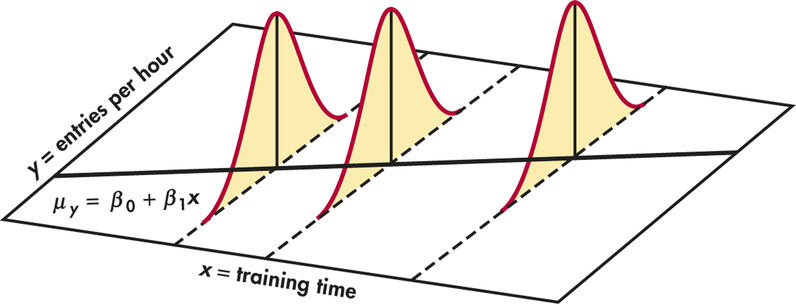

Key Features of Regression Line

- Regression line is BLUE: Best Linear Unbiased Estimator

- What exactly is it the “best” linear estimator of?

\[ \widehat{y} = \underbrace{\widehat{\beta}_0}_{\mathclap{\small\begin{array}{c}\text{Estimated} \\[-5mm] \text{intercept}\end{array}}} ~+~ \underbrace{\widehat{\beta}_1}_{\mathclap{\small\begin{array}{c}\text{Estimated} \\[-4mm] \text{slope}\end{array}}}\cdot x \]

is chosen so that

\[ \widehat{\theta} = \left(\widehat{\beta}_0, \widehat{\beta}_1\right) = \argmin_{\beta_0, \beta_1}\left[ \sum_{x_i \in X} \left(~~\overbrace{\widehat{y}(x_i)}^{\mathclap{\small\text{Predicted }y}} - \overbrace{\expect{Y \mid X = x_i}}^{\small \text{Avg. }y\text{ when }x = x_i}\right)^{2~} \right] \]

Where Did That \(\mathbb{E}[Y \mid X = x_i]\) Come From?

But… What About All the Other Types of Vars?

- 5000: you saw, e.g., nominal, ordinal, cardinal vars

- 5100: you wrestled with discrete vs. continuous RVs

- Good News #1: Regression can handle all these types+more!

- Good News #2: Distinctions between classification and regression start to diminish as you learn fancier regression methods! (One key tool here: link functions)

- By end of 5300 you should have something on your toolbelt for handling most cases like “I want to do [regression / classification], but my data is [not cardinal+continuous]”

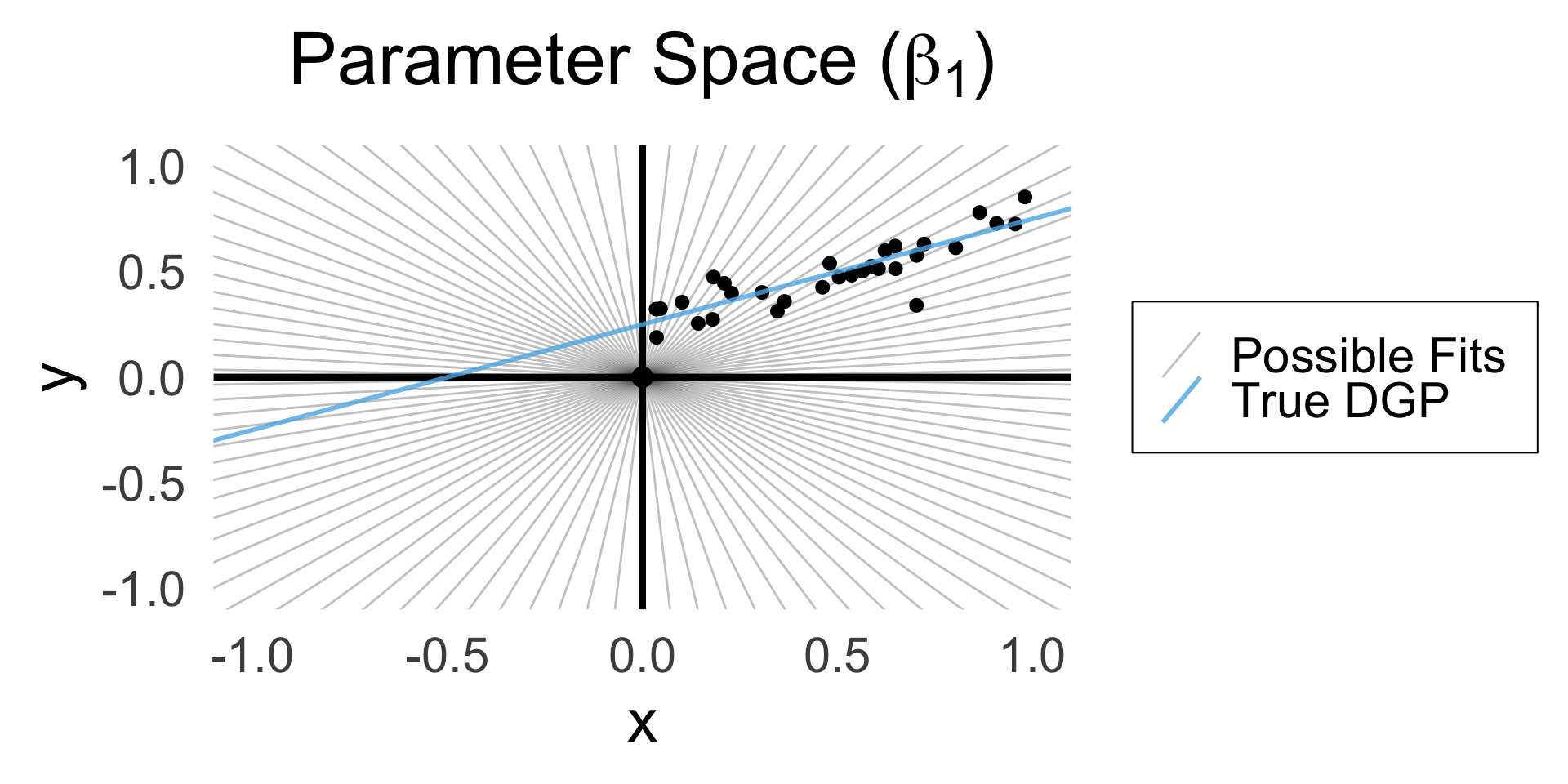

Deriving the Least Squares Estimate

A Sketch (HW is the Full Thing)

- OLS for regression without intercept \(\param{\beta_0}\): Which line through origin best predicts \(Y\)?

- (Good practice + reminder of how restricted linear models are!)

\[ Y = \beta_1 X + \varepsilon \]

Code

library(latex2exp)

set.seed(5300)

# rand_slope <- log(runif(80, min=0, max=1))

# rand_slope[41:80] <- -rand_slope[41:80]

# rand_lines <- tibble::tibble(

# id=1:80, slope=rand_slope, intercept=0

# )

# angles <- runif(100, -pi/2, pi/2)

angles <- seq(from=-pi/2, to=pi/2, length.out=50)

possible_lines <- tibble::tibble(

slope=tan(angles), intercept=0

)

num_points <- 30

x_vals <- runif(num_points, 0, 1)

y0_vals <- 0.5 * x_vals + 0.25

y_noise <- rnorm(num_points, 0, 0.07)

y_vals <- y0_vals + y_noise

rand_df <- tibble::tibble(x=x_vals, y=y_vals)

title_exp <- latex2exp("Parameter Space ($\\beta_1$)")

# Main plot object

gen_lines_plot <- function(point_size=2.5) {

lines_plot <- rand_df |> ggplot(aes(x=x, y=y)) +

geom_point(size=point_size) +

geom_hline(yintercept=0, linewidth=1.5) +

geom_vline(xintercept=0, linewidth=1.5) +

# Point at origin

geom_point(data=data.frame(x=0, y=0), aes(x=x, y=y), size=4) +

xlim(-1,1) +

ylim(-1,1) +

# coord_fixed() +

theme_dsan_min(base_size=28)

return(lines_plot)

}

main_lines_plot <- gen_lines_plot()

main_lines_plot +

# Parameter space of possible lines

geom_abline(

data=possible_lines,

aes(slope=slope, intercept=intercept, color='possible'),

# linetype="dotted",

# linewidth=0.75,

alpha=0.25

) +

# True DGP

geom_abline(

aes(

slope=0.5,

intercept=0.25,

color='true'

), linewidth=1, alpha=0.8

) +

scale_color_manual(

element_blank(),

values=c('possible'="black", 'true'=cb_palette[2]),

labels=c('possible'="Possible Fits", 'true'="True DGP")

) +

remove_legend_title() +

labs(

title=title_exp

)

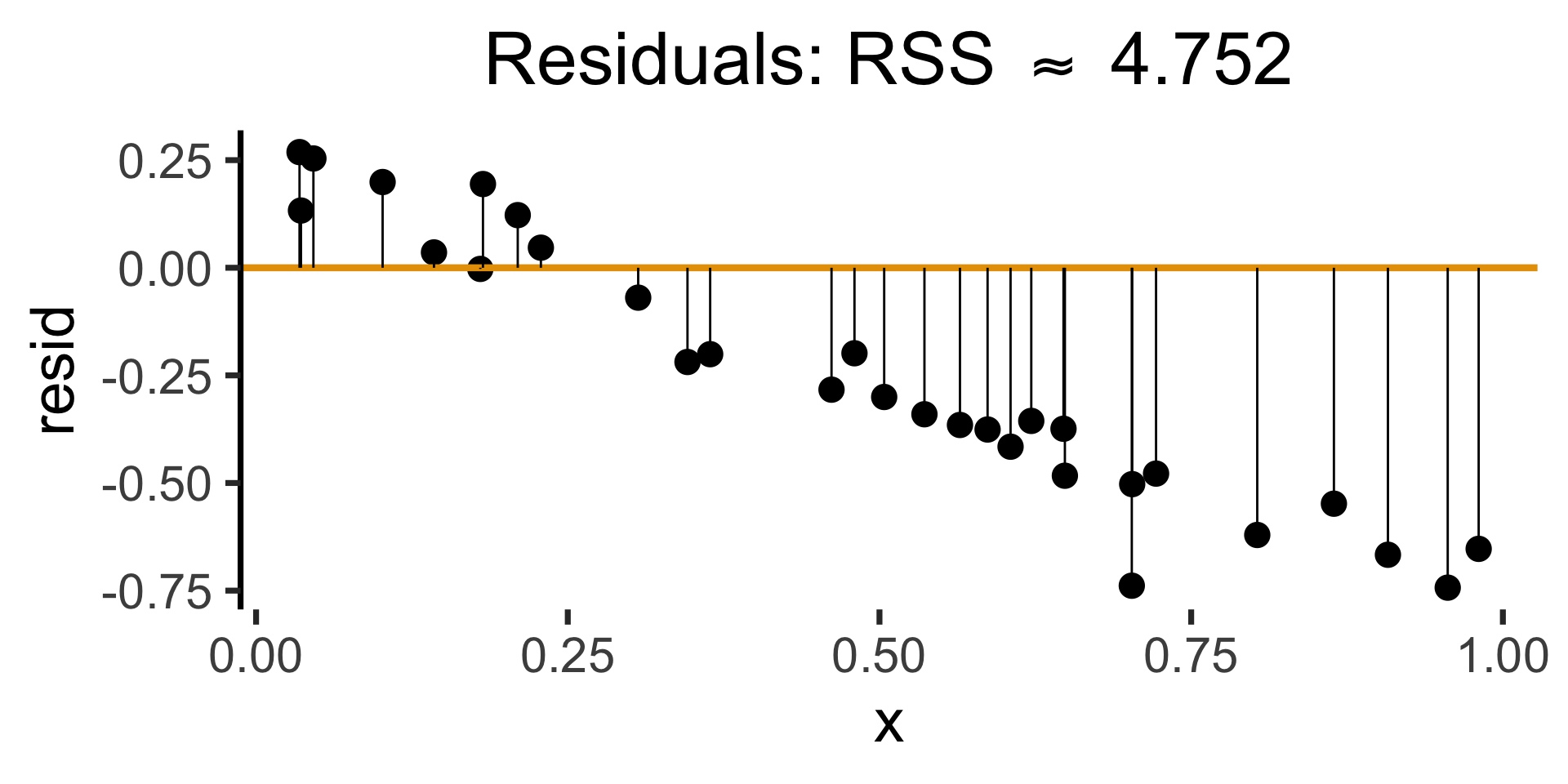

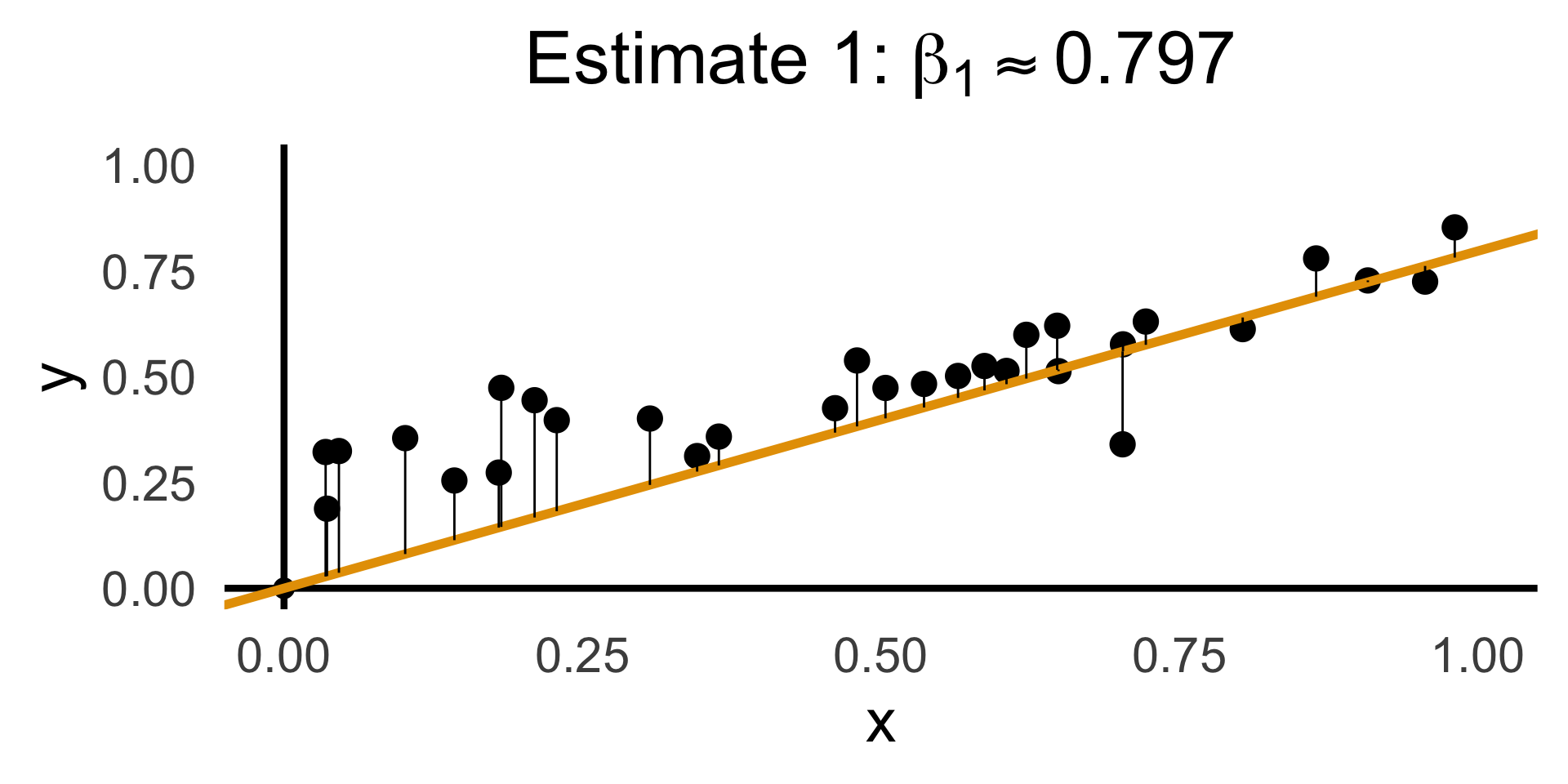

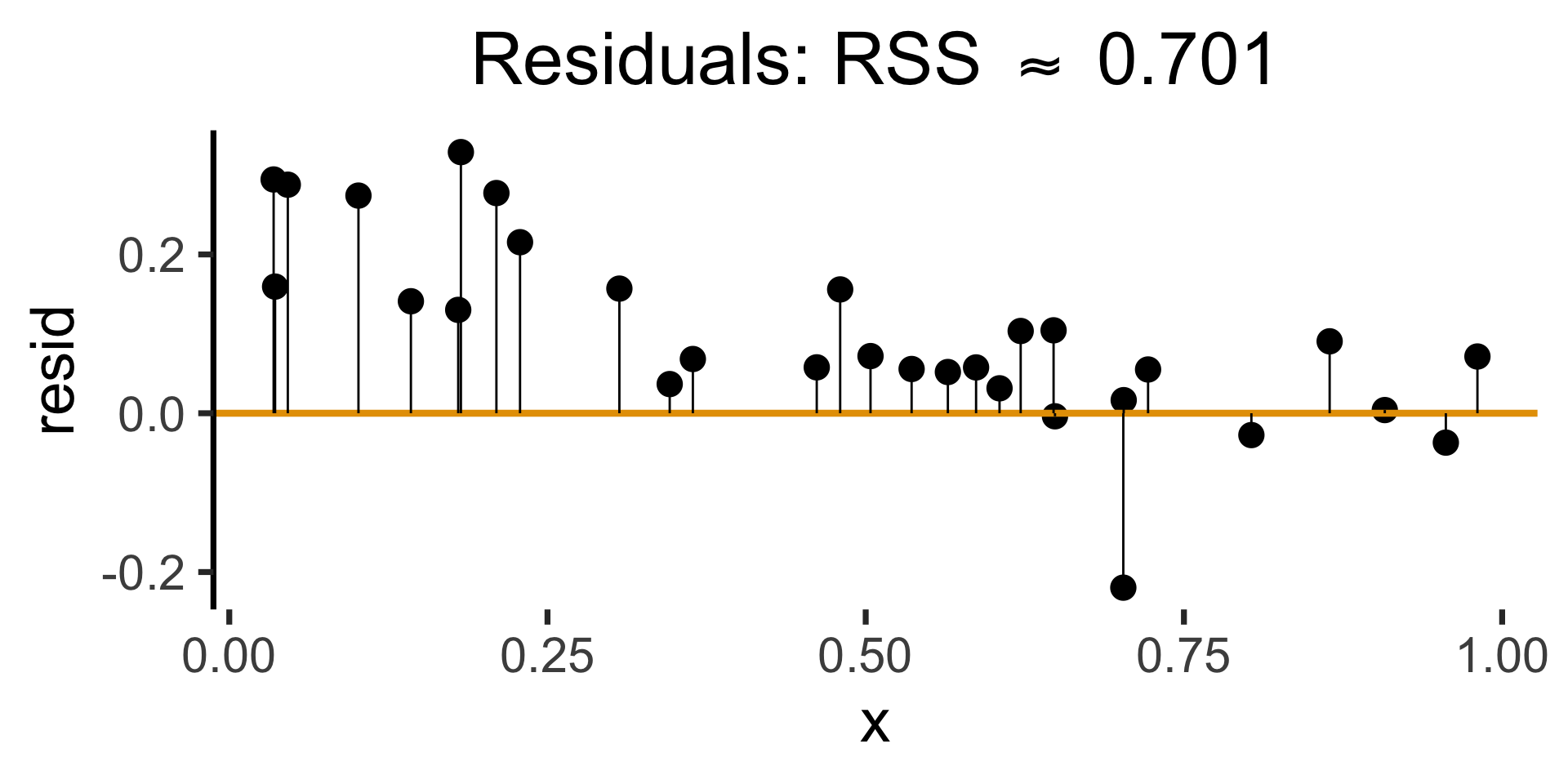

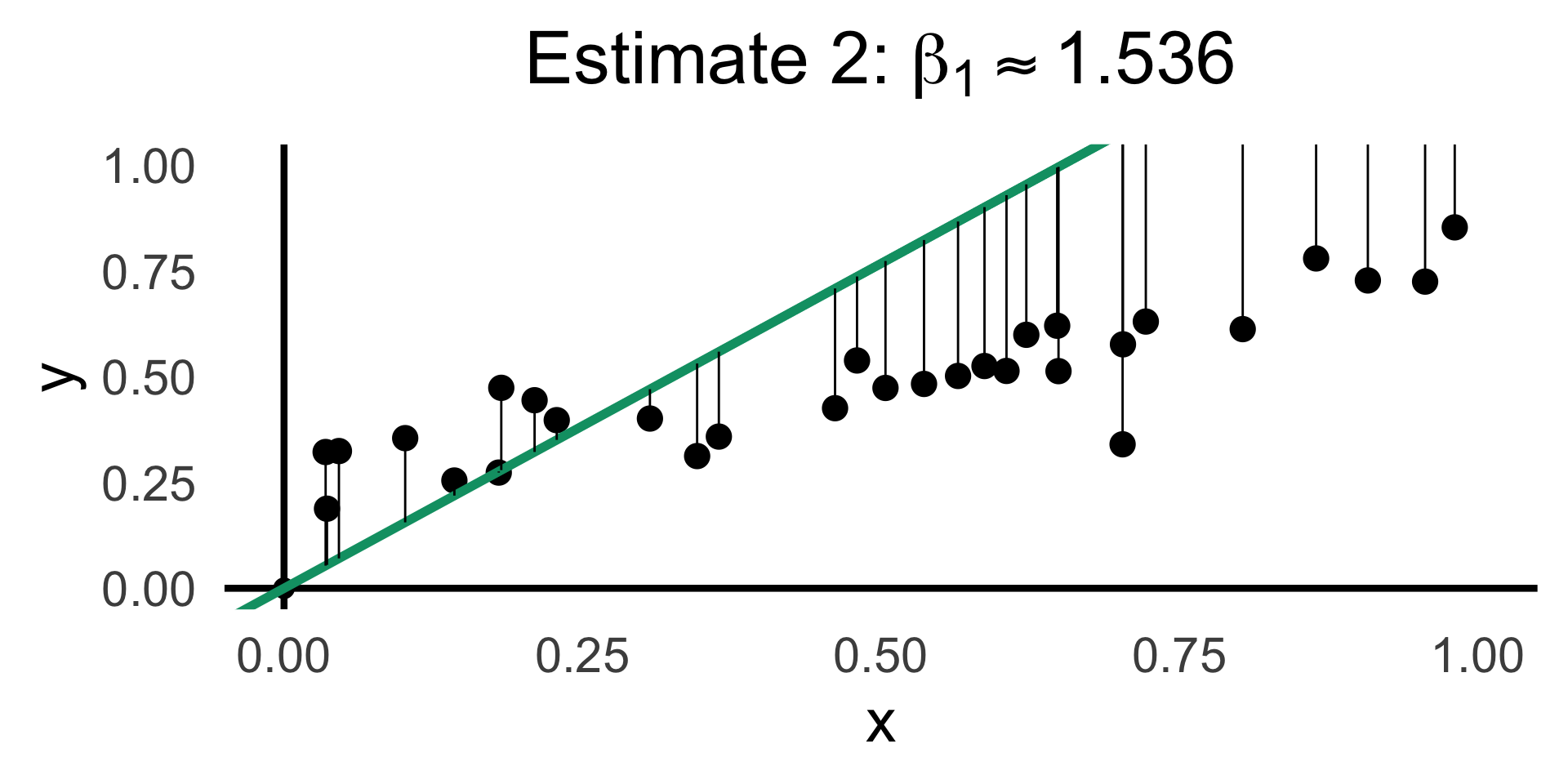

Evaluating with Residuals

Code

rc1_df <- possible_lines |> slice(n() - 14)

# Predictions for this choice

rc1_pred_df <- rand_df |> mutate(

y_pred = rc1_df$slope * x,

resid = y - y_pred

)

rc1_label <- latex2exp(paste0("Estimate 1: $\\beta_1 \\approx ",round(rc1_df$slope, 3),"$"))

rc1_lines_plot <- gen_lines_plot(point_size=5)

rc1_lines_plot +

geom_abline(

data=rc1_df,

aes(intercept=intercept, slope=slope),

linewidth=2,

color=cb_palette[1]

) +

geom_segment(

data=rc1_pred_df,

aes(x=x, y=y, xend=x, yend=y_pred),

# color=cb_palette[1]

) +

xlim(0, 1) + ylim(0, 1) +

labs(

title = rc1_label

)

Code

gen_resid_plot <- function(pred_df) {

rc_rss <- sum((pred_df$resid)^2)

rc_resid_label <- latex2exp(paste0("Residuals: RSS $\\approx$ ",round(rc_rss,3)))

rc_resid_plot <- pred_df |> ggplot(aes(x=x, y=resid)) +

geom_point(size=5) +

geom_hline(

yintercept=0,

color=cb_palette[1],

linewidth=1.5

) +

geom_segment(

aes(xend=x, yend=0)

) +

theme_dsan(base_size=28) +

theme(axis.line.x = element_blank()) +

labs(

title=rc_resid_label

)

return(rc_resid_plot)

}

rc1_resid_plot <- gen_resid_plot(rc1_pred_df)

rc1_resid_plot

Code

rc2_df <- possible_lines |> slice(n() - 9)

# Predictions for this choice

rc2_pred_df <- rand_df |> mutate(

y_pred = rc2_df$slope * x,

resid = y - y_pred

)

rc2_label <- latex2exp(paste0("Estimate 2: $\\beta_1 \\approx ",round(rc2_df$slope,3),"$"))

rc2_lines_plot <- gen_lines_plot(point_size=5)

rc2_lines_plot +

geom_abline(

data=rc2_df,

aes(intercept=intercept, slope=slope),

linewidth=2,

color=cb_palette[3]

) +

geom_segment(

data=rc2_pred_df,

aes(

x=x, y=y, xend=x,

yend=ifelse(y_pred <= 1, y_pred, Inf)

)

# color=cb_palette[1]

) +

xlim(0, 1) + ylim(0, 1) +

labs(

title=rc2_label

)

Now the Math

\[ \begin{align*} \beta_1^* = \argmin_{\beta_1}\left[ \sum_{i=1}^{n}(\widehat{y}_i - y_i)^2 \right] = \argmin_{\beta_1}\left[ \sum_{i=1}^{n}(\beta_1x_i - y_i)^2 \right] \end{align*} \]

We can compute this derivative to obtain:

\[ \frac{\partial}{\partial\beta_1}\left[ \sum_{i=1}^{n}(\beta_1x_i - y_i)^2 \right] = \sum_{i=1}^{n}\frac{\partial}{\partial\beta_1}(\beta_1x_i - y_i)^2 = \sum_{i=1}^{n}2(\beta_1x_i - y_i)x_i \]

And our first-order condition means that:

\[ \sum_{i=1}^{n}2(\beta_1^*x_i - y_i)x_i = 0 \iff \beta_1^*\sum_{i=1}^{n}x_i^2 = \sum_{i=1}^{n}x_iy_i \iff \boxed{\beta_1^* = \frac{\sum_{i=1}^{n}x_iy_i}{\sum_{i=1}^{n}x_i^2}} \]

Doing Things With Regression

Regression: R vs. statsmodels

lm()

Call:

lm(formula = sales ~ TV, data = ad_df)

Residuals:

Min 1Q Median 3Q Max

-8.3860 -1.9545 -0.1913 2.0671 7.2124

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 7.032594 0.457843 15.36 <2e-16 ***

TV 0.047537 0.002691 17.67 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 3.259 on 198 degrees of freedom

Multiple R-squared: 0.6119, Adjusted R-squared: 0.6099

F-statistic: 312.1 on 1 and 198 DF, p-value: < 2.2e-16General syntax:

smf.ols()

Code

OLS Regression Results

==============================================================================

Dep. Variable: sales R-squared: 0.612

Model: OLS Adj. R-squared: 0.610

No. Observations: 200 F-statistic: 312.1

Covariance Type: nonrobust Prob (F-statistic): 1.47e-42

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 7.0326 0.458 15.360 0.000 6.130 7.935

TV 0.0475 0.003 17.668 0.000 0.042 0.053

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.General syntax:

Interpreting Output

Call:

lm(formula = military ~ industrial, data = gdp_df)

Residuals:

Min 1Q Median 3Q Max

-2.3354 -1.0997 -0.3870 0.6081 6.7508

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.61969 0.59526 1.041 0.3010

industrial 0.05253 0.02019 2.602 0.0111 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 1.671 on 79 degrees of freedom

(8 observations deleted due to missingness)

Multiple R-squared: 0.07895, Adjusted R-squared: 0.06729

F-statistic: 6.771 on 1 and 79 DF, p-value: 0.01106Zooming In: Coefficients

| Estimate | Std. Error | t value | Pr(>|t|) | ||

|---|---|---|---|---|---|

| (Intercept) | 0.61969 | 0.59526 | 1.041 | 0.3010 | |

| industrial | 0.05253 | 0.02019 | 2.602 | 0.0111 | * |

| \(\widehat{\beta}\) | Uncertainty | Test stat \(t\) | How extreme is \(t\)? | Signif. Level |

\[ \widehat{y} \approx \class{cb1}{\overset{\beta_0}{\underset{\small \pm 0.595}{0.620}}} + \class{cb2}{\overset{\beta_1}{\underset{\small \pm 0.020}{0.053}}} \cdot x \]

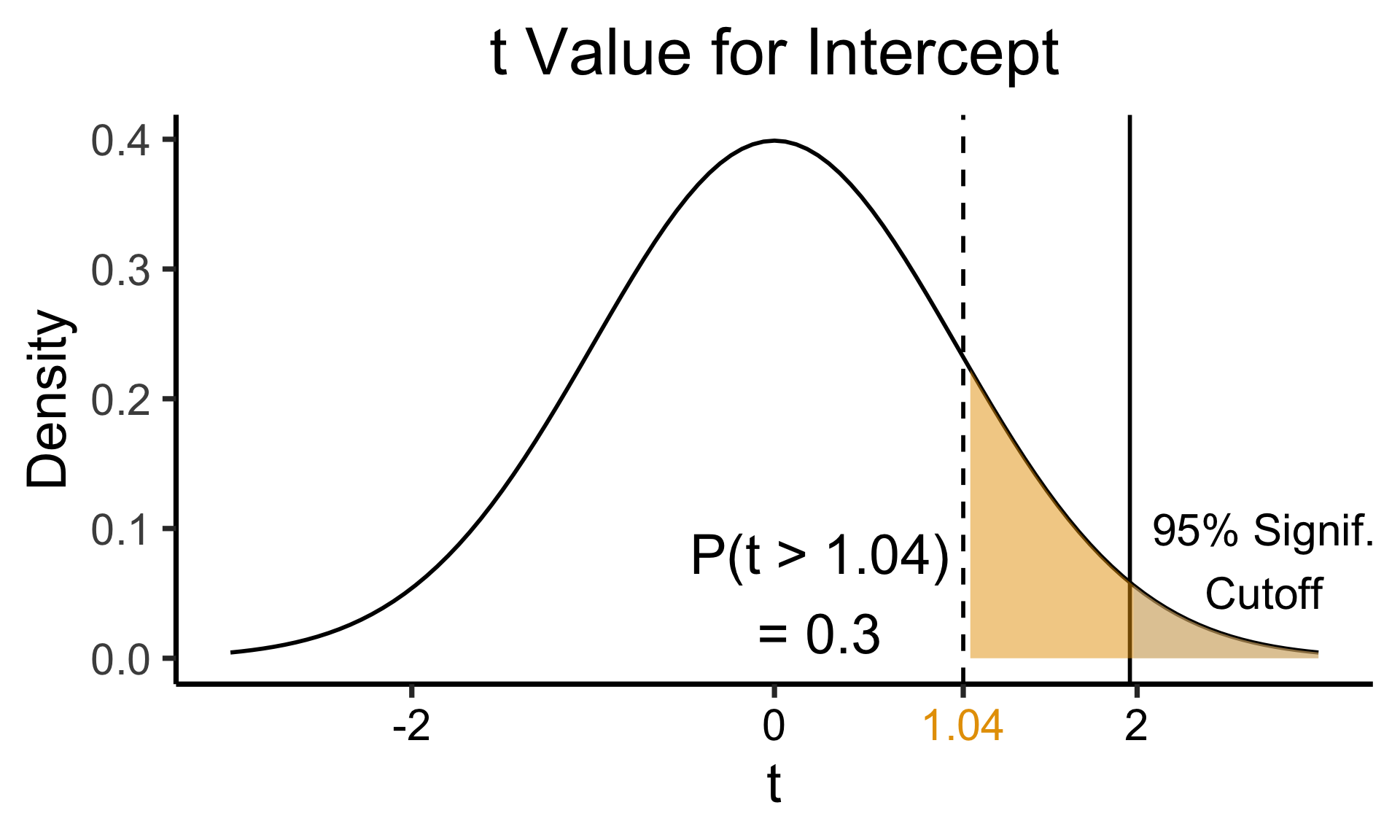

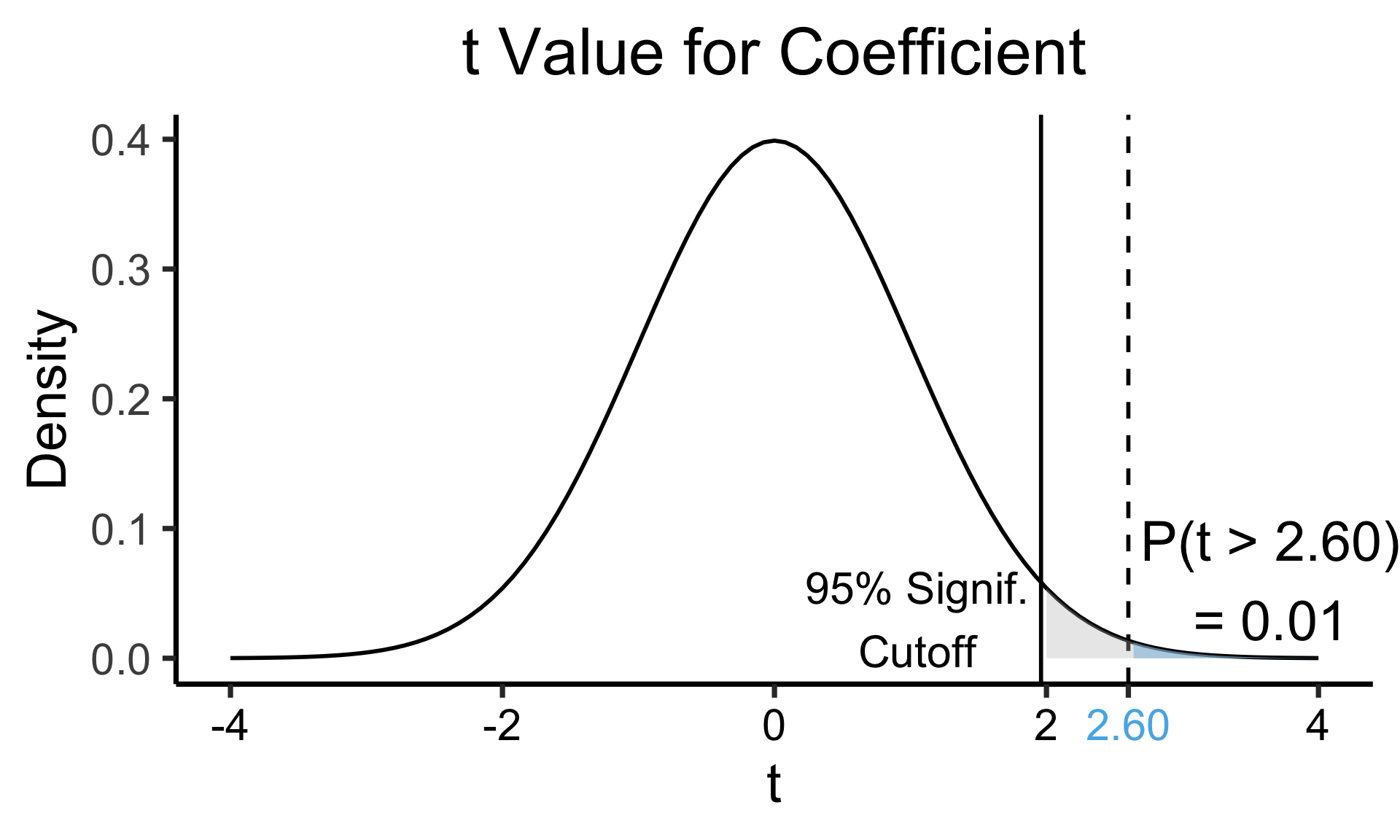

Zooming In: Significance

| Estimate | Std. Error | t value | Pr(>|t|) | ||

|---|---|---|---|---|---|

| (Intercept) | 0.61969 | 0.59526 | 1.041 | 0.3010 | |

| industrial | 0.05253 | 0.02019 | 2.602 | 0.0111 | * |

| \(\widehat{\beta}\) | Uncertainty | Test stat \(t\) | How extreme is \(t\)? | Signif. Level |

Code

library(ggplot2)

int_tstat <- 1.041

int_tstat_str <- sprintf("%.02f", int_tstat)

label_df_int <- tribble(

~x, ~y, ~label,

0.25, 0.05, paste0("P(t > ",int_tstat_str,")\n= 0.3")

)

label_df_signif_int <- tribble(

~x, ~y, ~label,

2.7, 0.075, "95% Signif.\nCutoff"

)

funcShaded <- function(x, lower_bound, upper_bound){

y <- dnorm(x)

y[x < lower_bound | x > upper_bound] <- NA

return(y)

}

funcShadedIntercept <- function(x) funcShaded(x, int_tstat, Inf)

funcShadedSignif <- function(x) funcShaded(x, 1.96, Inf)

ggplot(data=data.frame(x=c(-3,3)), aes(x=x)) +

stat_function(fun=dnorm, linewidth=g_linewidth) +

geom_vline(aes(xintercept=int_tstat), linewidth=g_linewidth, linetype="dashed") +

geom_vline(aes(xintercept = 1.96), linewidth=g_linewidth, linetype="solid") +

stat_function(fun = funcShadedIntercept, geom = "area", fill = cbPalette[1], alpha = 0.5) +

stat_function(fun = funcShadedSignif, geom = "area", fill = "grey", alpha = 0.333) +

geom_text(label_df_int, mapping = aes(x = x, y = y, label = label), size = 10) +

geom_text(label_df_signif_int, mapping = aes(x = x, y = y, label = label), size = 8) +

# Add single additional tick

scale_x_continuous(breaks=c(-2, 0, int_tstat, 2), labels=c("-2","0",int_tstat_str,"2")) +

dsan_theme("quarter") +

labs(

title = "t Value for Intercept",

x = "t",

y = "Density"

) +

theme(axis.text.x = element_text(colour = c("black", "black", cbPalette[1], "black")))

Code

library(ggplot2)

coef_tstat <- 2.602

coef_tstat_str <- sprintf("%.02f", coef_tstat)

label_df_coef <- tribble(

~x, ~y, ~label,

3.65, 0.06, paste0("P(t > ",coef_tstat_str,")\n= 0.01")

)

label_df_signif_coef <- tribble(

~x, ~y, ~label,

1.05, 0.03, "95% Signif.\nCutoff"

)

funcShadedCoef <- function(x) funcShaded(x, coef_tstat, Inf)

ggplot(data=data.frame(x=c(-4,4)), aes(x=x)) +

stat_function(fun=dnorm, linewidth=g_linewidth) +

geom_vline(aes(xintercept=coef_tstat), linetype="dashed", linewidth=g_linewidth) +

geom_vline(aes(xintercept=1.96), linetype="solid", linewidth=g_linewidth) +

stat_function(fun = funcShadedCoef, geom = "area", fill = cbPalette[2], alpha = 0.5) +

stat_function(fun = funcShadedSignif, geom = "area", fill = "grey", alpha = 0.333) +

# Label shaded area

geom_text(label_df_coef, mapping = aes(x = x, y = y, label = label), size = 10) +

# Label significance cutoff

geom_text(label_df_signif_coef, mapping = aes(x = x, y = y, label = label), size = 8) +

coord_cartesian(clip = "off") +

# Add single additional tick

scale_x_continuous(breaks=c(-4, -2, 0, 2, coef_tstat, 4), labels=c("-4", "-2","0", "2", coef_tstat_str,"4")) +

dsan_theme("quarter") +

labs(

title = "t Value for Coefficient",

x = "t",

y = "Density"

) +

theme(axis.text.x = element_text(colour = c("black", "black", "black", "black", cbPalette[2], "black")))

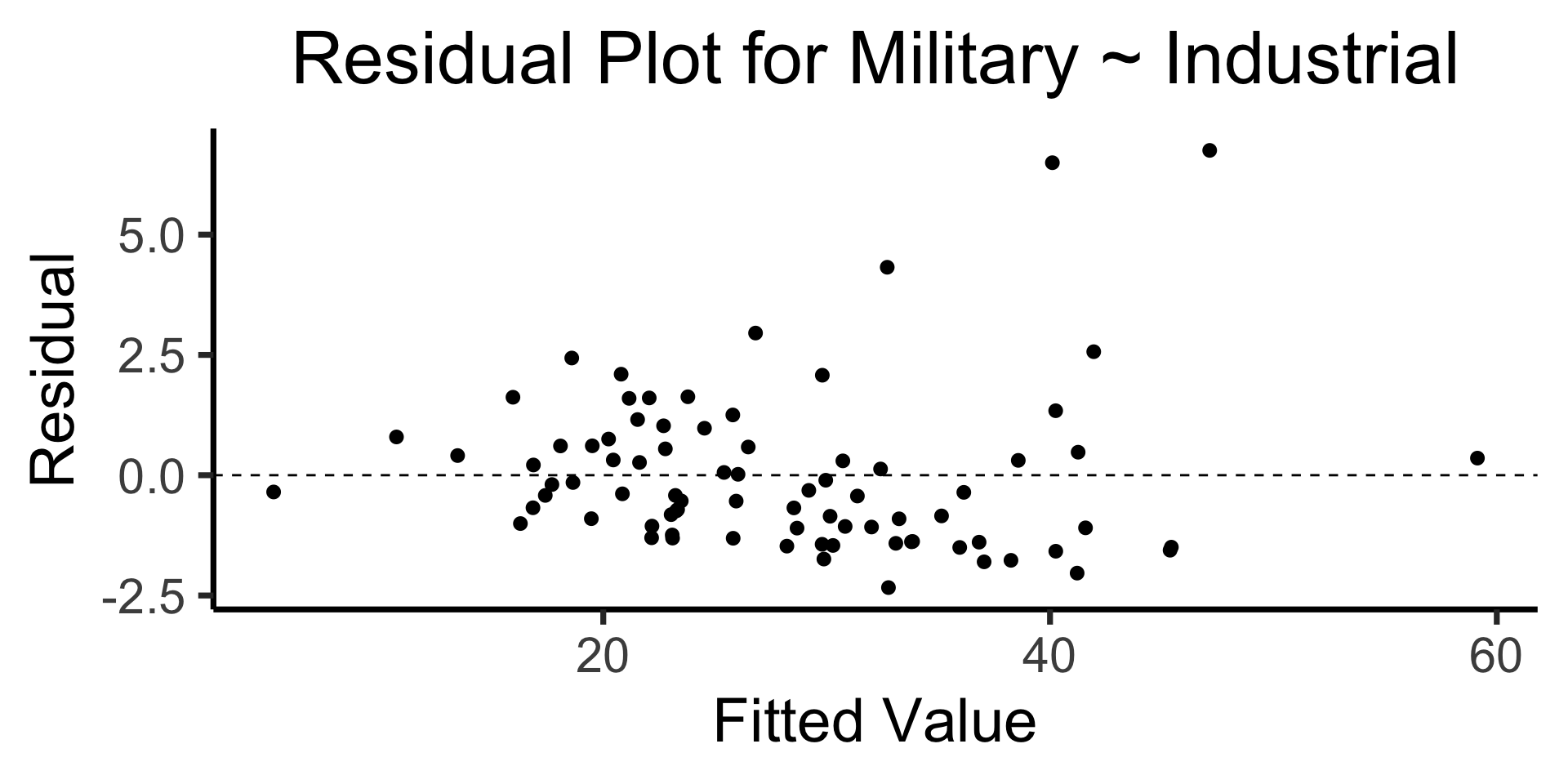

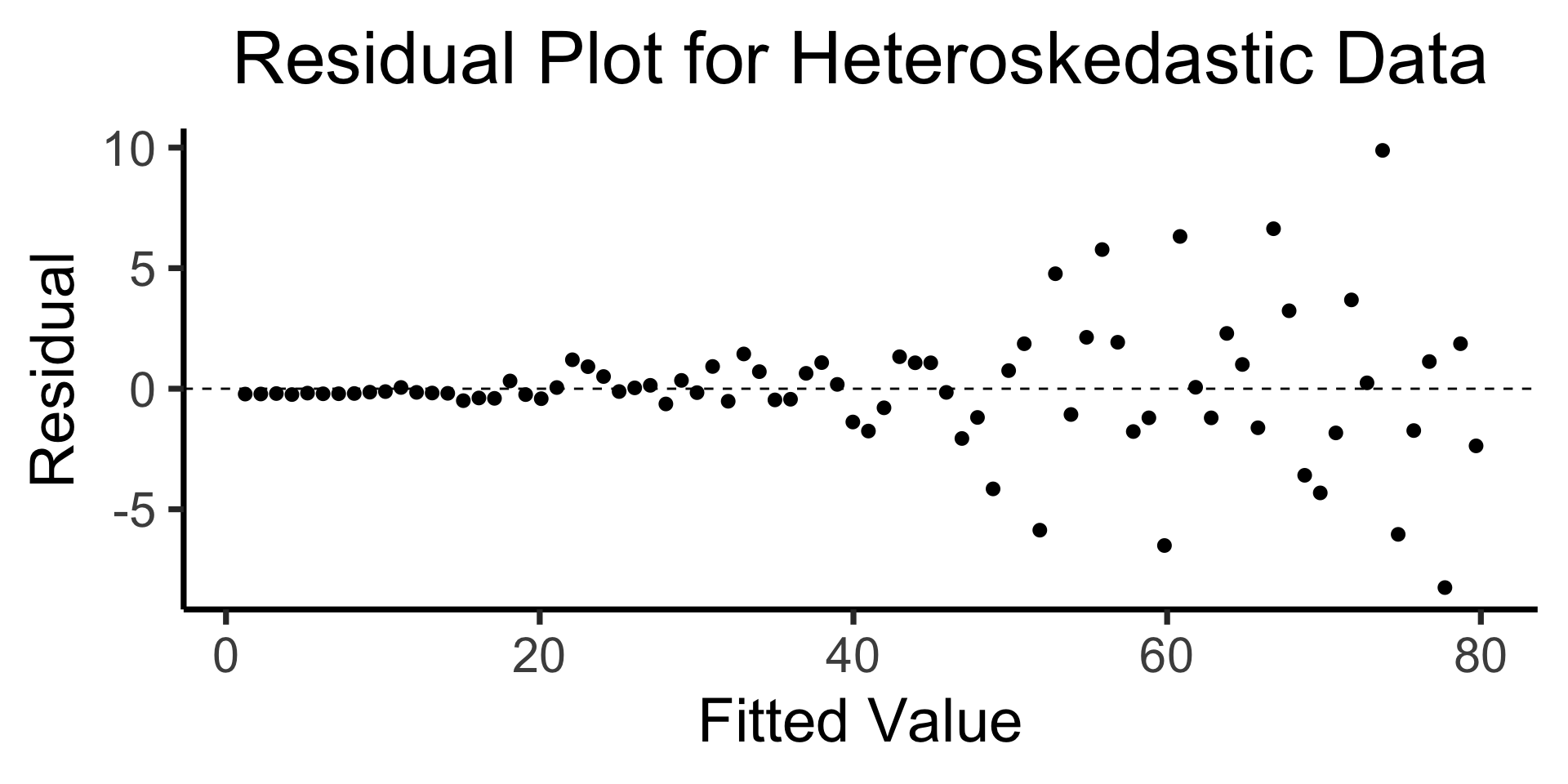

The Residual Plot

- A key assumption required for OLS: “homoskedasticity”

- Given our model \[ y_i = \beta_0 + \beta_1x_i + \varepsilon_i \] the errors \(\varepsilon_i\) should not vary systematically with \(i\)

- Formally: \(\forall i \left[ \Var{\varepsilon_i} = \sigma^2 \right]\)

Code

library(broom)

gdp_resid_df <- augment(gdp_model)

ggplot(gdp_resid_df, aes(x = industrial, y = .resid)) +

geom_point(size = g_pointsize/2) +

geom_hline(yintercept=0, linetype="dashed") +

dsan_theme("quarter") +

labs(

title = "Residual Plot for Military ~ Industrial",

x = "Fitted Value",

y = "Residual"

)

Code

x <- 1:80

errors <- rnorm(length(x), 0, x^2/1000)

y <- x + errors

het_model <- lm(y ~ x)

df_het <- augment(het_model)

ggplot(df_het, aes(x = .fitted, y = .resid)) +

geom_point(size = g_pointsize / 2) +

geom_hline(yintercept = 0, linetype = "dashed") +

dsan_theme("quarter") +

labs(

title = "Residual Plot for Heteroskedastic Data",

x = "Fitted Value",

y = "Residual"

)

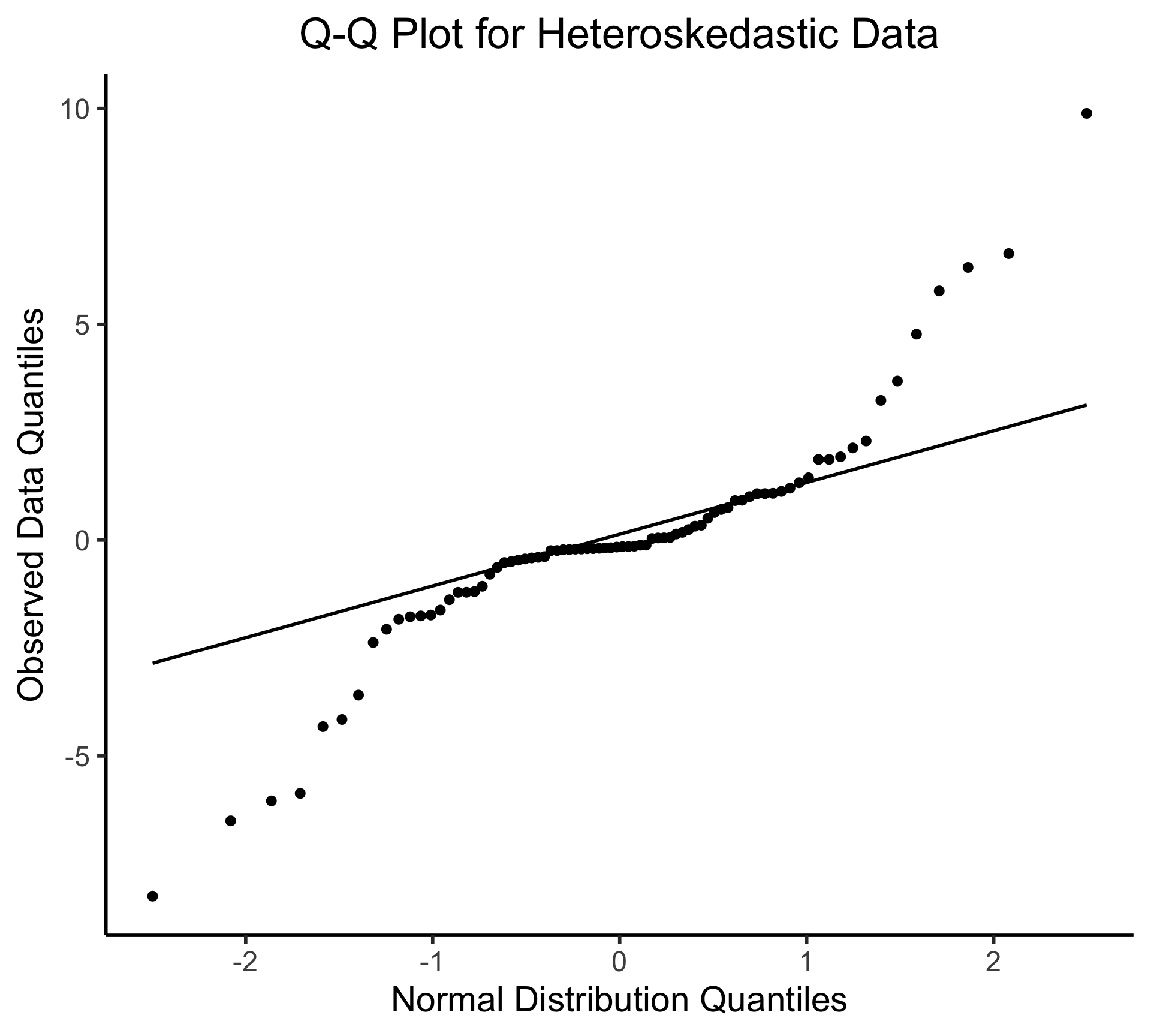

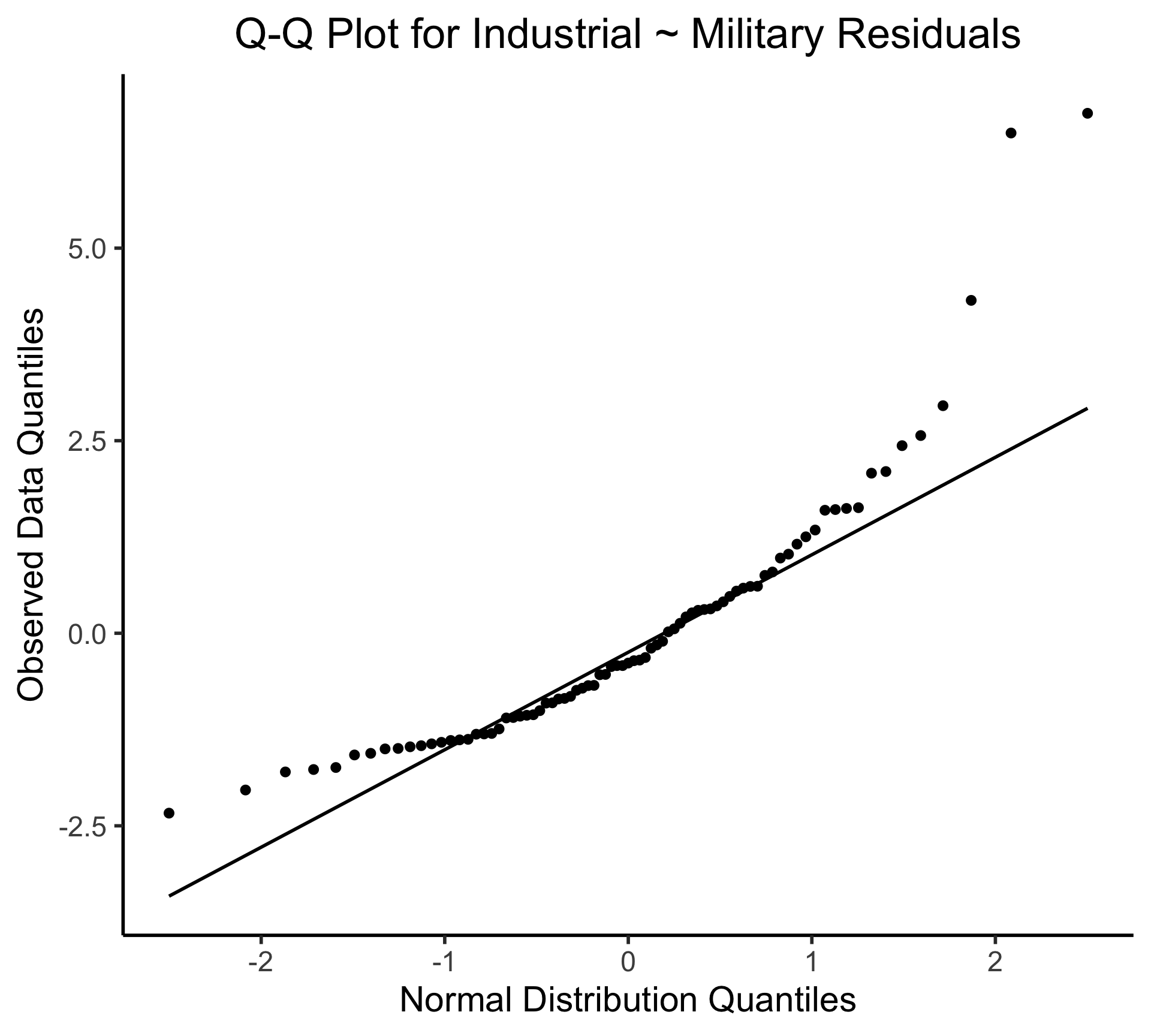

Q-Q Plot

- If \((\widehat{y} - y) \sim \mathcal{N}(0, \sigma^2)\), points would lie on 45° line:

Multiple Linear Regression

- Notation: \(x_{i,j}\) = value of independent variable \(j\) for person/observation \(i\)

- \(M\) = total number of independent variables

\[ \widehat{y}_i = \beta_0 + \beta_1x_{i,1} + \beta_2x_{i,2} + \cdots + \beta_M x_{i,M} \]

- \(\beta_j\) interpretation: a one-unit increase in \(x_{i,j}\) is associated with a \(\beta_j\) unit increase in \(y_i\), holding all other independent variables constant

Visualizing Multiple Linear Regression

(ISLR, Fig 3.5): A pronounced non-linear relationship. Positive residuals (visible above the surface) tend to lie along the 45-degree line, where budgets are split evenly. Negative residuals (most not visible) tend to be away from this line, where budgets are more lopsided.

Interpreting MLR

Call:

lm(formula = sales ~ TV + radio + newspaper, data = ad_df)

Residuals:

Min 1Q Median 3Q Max

-8.8277 -0.8908 0.2418 1.1893 2.8292

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.938889 0.311908 9.422 <2e-16 ***

TV 0.045765 0.001395 32.809 <2e-16 ***

radio 0.188530 0.008611 21.893 <2e-16 ***

newspaper -0.001037 0.005871 -0.177 0.86

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 1.686 on 196 degrees of freedom

Multiple R-squared: 0.8972, Adjusted R-squared: 0.8956

F-statistic: 570.3 on 3 and 196 DF, p-value: < 2.2e-16- Holding

radioandnewspaperspending constant…- An increase of $1K in spending on

TVadvertising is associated with - An increase in sales of about 46 units

- An increase of $1K in spending on

- Holding

TVandnewspaperspending constant…- An increase of $1K in spending on

radioadvertising is associated with - An increase in sales of about 189 units

- An increase of $1K in spending on

But Wait…

Call:

lm(formula = sales ~ TV + radio + newspaper, data = ad_df)

Residuals:

Min 1Q Median 3Q Max

-8.8277 -0.8908 0.2418 1.1893 2.8292

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.938889 0.311908 9.422 <2e-16 ***

TV 0.045765 0.001395 32.809 <2e-16 ***

radio 0.188530 0.008611 21.893 <2e-16 ***

newspaper -0.001037 0.005871 -0.177 0.86

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 1.686 on 196 degrees of freedom

Multiple R-squared: 0.8972, Adjusted R-squared: 0.8956

F-statistic: 570.3 on 3 and 196 DF, p-value: < 2.2e-16

Call:

lm(formula = sales ~ newspaper, data = ad_df)

Residuals:

Min 1Q Median 3Q Max

-11.2272 -3.3873 -0.8392 3.5059 12.7751

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 12.35141 0.62142 19.88 < 2e-16 ***

newspaper 0.05469 0.01658 3.30 0.00115 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 5.092 on 198 degrees of freedom

Multiple R-squared: 0.05212, Adjusted R-squared: 0.04733

F-statistic: 10.89 on 1 and 198 DF, p-value: 0.001148- MLR results can be drastically different from SLR results, because of correlations (next slide)

- This is a good thing! It’s how we’re able to control for confounding variables!

Correlations Among Features

TV radio newspaper sales

TV 1.00000000 0.05480866 0.05664787 0.7822244

radio 0.05480866 1.00000000 0.35410375 0.5762226

newspaper 0.05664787 0.35410375 1.00000000 0.2282990

sales 0.78222442 0.57622257 0.22829903 1.0000000- Observe how \(\text{cor}(\texttt{radio}, \texttt{newspaper}) \approx 0.35\)

- In markets where we spend more on

radioour sales will tend to be higher… - Corr matrix \(\implies\) we spend more on

newspaperin those same markets… - In SLR which only examines

salesvs.newspaper, we (correctly!) observe that higher values ofnewspaperare associated with higher values ofsales… - In essence,

newspaperadvertising is a surrogate forradioadvertising \(\implies\) in our SLR,newspaper“gets credit” for the association betweenradioandsales

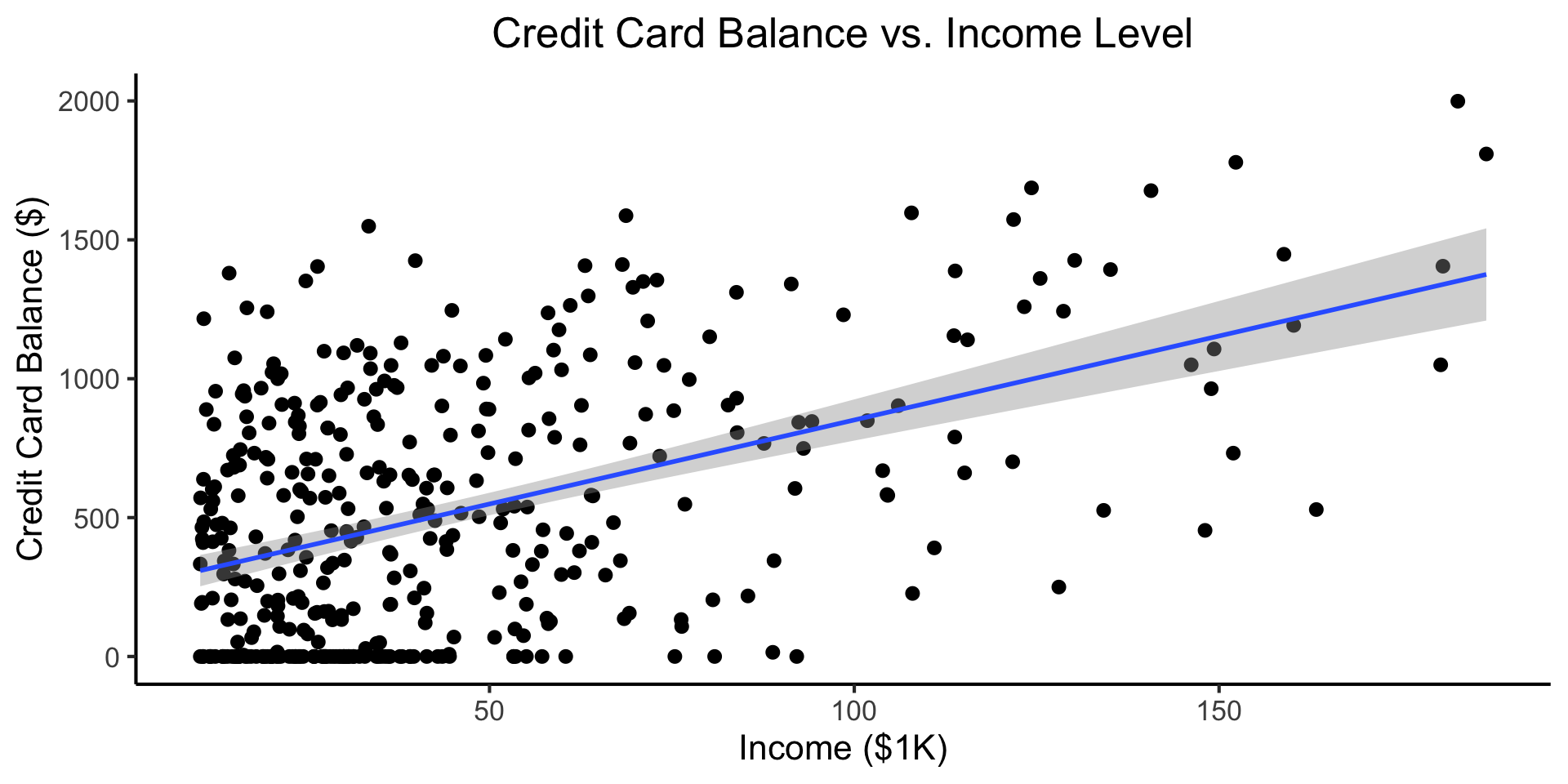

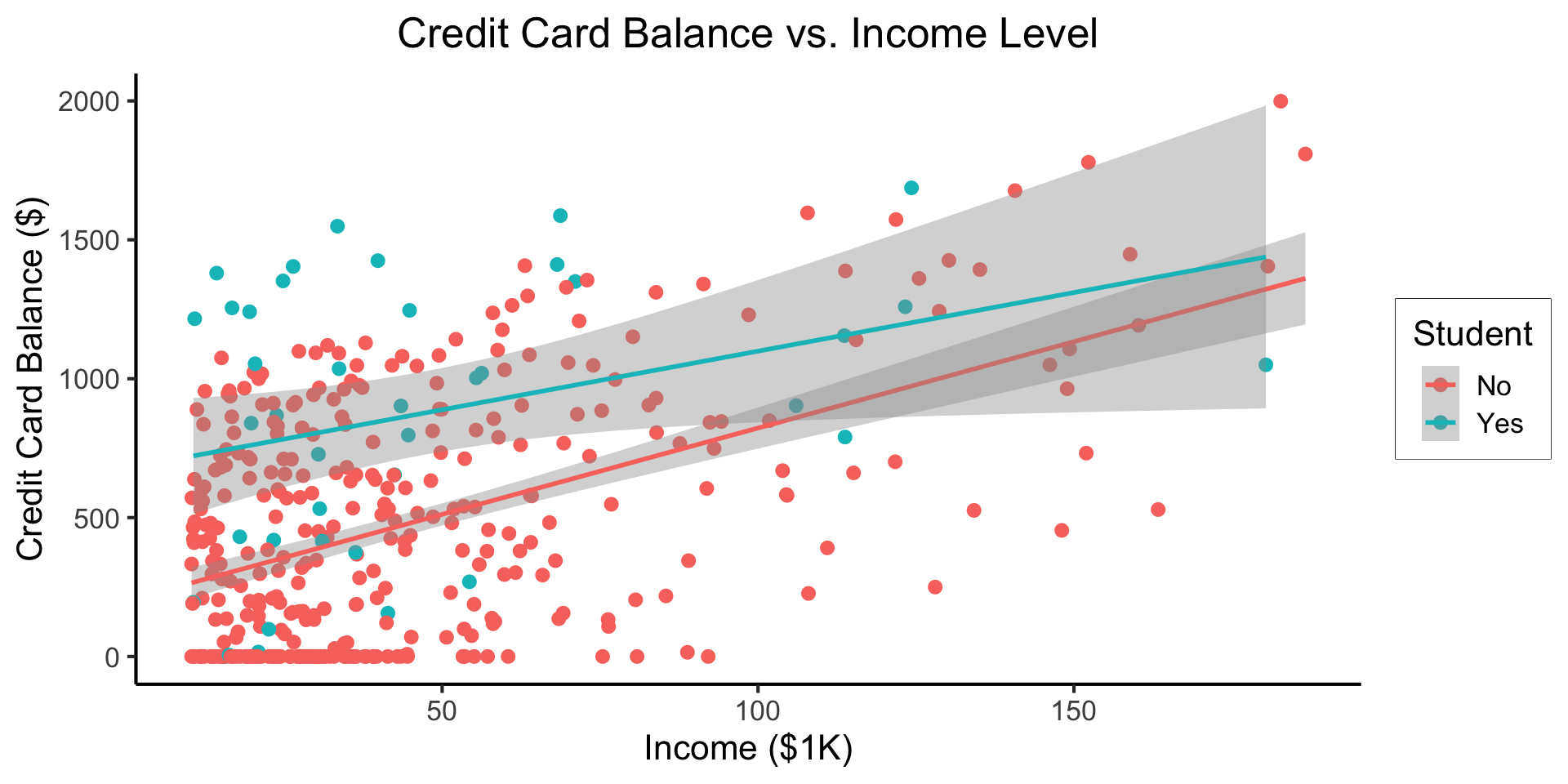

Another MLR Superpower: Incorporating Categorical Vars

(Preview for next week)

\[ Y = \beta_0 + \beta_1 \times \texttt{income} \]

Code

credit_df <- read_csv("assets/Credit.csv")

credit_plot <- credit_df |> ggplot(aes(x=Income, y=Balance)) +

geom_point(size=0.5*g_pointsize) +

geom_smooth(method='lm', formula="y ~ x", linewidth=1) +

theme_dsan() +

labs(

title="Credit Card Balance vs. Income Level",

x="Income ($1K)",

y="Credit Card Balance ($)"

)

credit_plot

\[ \begin{align*} Y = &\beta_0 + \beta_1 \times \texttt{income} + \beta_2 \times \texttt{Student} \\ &+ \beta_3 \times (\texttt{Student} \times \texttt{Income}) \end{align*} \]

Code

- Why do we need the \(\texttt{Student} \times \texttt{Income}\) term?

- Understanding this setup will open up a vast array of possibilities for regression 😎

References

DSAN 5300-01 Week 2: Linear Regression